US House Financial Services Committee Chair, Patrick T. McHenry, has announced his plans to schedule a vote on a bill regulating digital assets by the middle of July. The bill in question, known as the Digital Asset Market Structure Discussion Draft, seeks to establish guidelines for cryptocurrencies, including their classification as either securities or commodities, while implementing regulations for exchanges and introducing other measures.

A significant aspect of the proposed legislation is creating a framework granting jurisdiction over digital commodities to the Commodity Futures Trading Commission. Furthermore, it aims to clarify the authority of the Securities and Exchange Commission concerning “digital assets offered as part of an investment contract.”

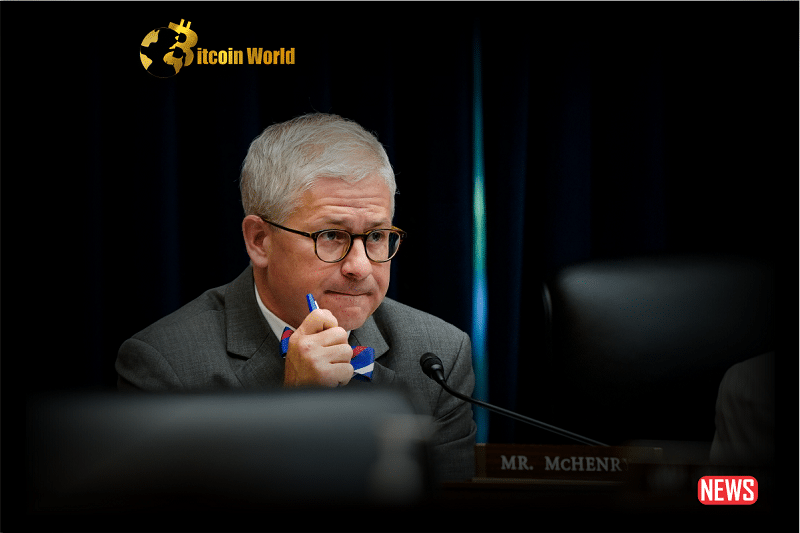

During a recent House Financial Services Committee hearing, McHenry expressed his desire for a bipartisan approach, emphasizing collaboration among committee members. He acknowledged that the current document is a draft bill and there is ample time for consensus on the legislative process. However, he made it clear that he intends for the committee to finalize and markup some version of this legislation after the July 4 recess, as the House reconvenes on July 11.

Former chair of the House Financial Services Committee, Maxine Waters, raised concerns about the bill, specifically pointing out its potential to impede the Securities and Exchange Commission’s ability to take action against fraudulent activities by cryptocurrency firms. Waters believes providing provisional registration could enable wrongdoers to evade accountability and continue harming consumers and investors.

This hearing follows a recent lawsuit the Securities and Exchange Commission filed against major cryptocurrency exchanges, Binance and Coinbase. The SEC accused Coinbase of operating its platform without registering as an exchange broker or clearing agency. Additionally, Binance and its CEO, Changpeng Zhao, faced charges, including misleading investors and unlawful operation as an exchange.

In response to the lawsuit, SEC Chair Gary Gensler argued that exchanges can register with the agency, countering assertions made by some platforms that such registration was not feasible.

As the House Financial Services Committee gears up to vote on the bill in July, this legislation’s outcome will undoubtedly significantly impact the regulatory landscape surrounding digital assets. The industry and government stakeholders will closely monitor the progress and implications of these proposed regulations, which aim to strike a balance between protecting investors and fostering innovation in the evolving digital asset market.