Navigating the volatile crypto market can feel like riding a rollercoaster, right? Especially when it comes to Ethereum (ETH), the second-largest cryptocurrency. Recently, ETH has been on a bit of a journey, dipping below the $3,000 mark and causing some jitters in the crypto community. But don’t worry, let’s break down what’s happening with Ethereum’s price and what it could mean for you, whether you’re a seasoned trader or just dipping your toes into the crypto waters.

Ethereum’s Recent Price Movements: A Quick Recap

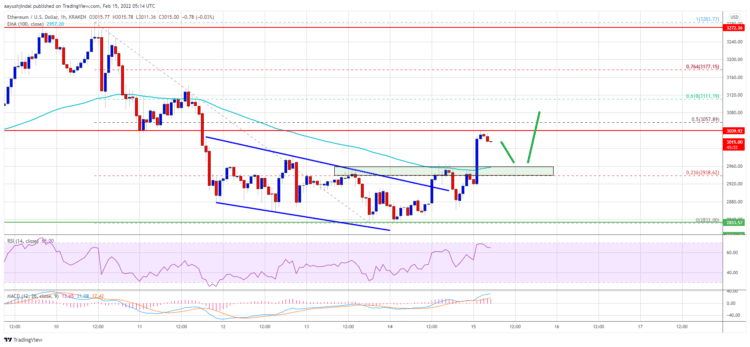

Ethereum took a bit of a tumble recently, falling below the critical $3,000 support level and the 100-hour simple moving average. For those unfamiliar, the 100-hour simple moving average is like a temperature check for the market over the last 100 hours – it gives traders an idea of the average price trend. When ETH dipped below this, it signaled a downward trend. However, just when things looked a bit shaky, around $2,830, ETH found its footing. This level became a new support base, acting like a floor and setting the stage for a potential rebound.

From this base, Ethereum started to climb back up, successfully breaking through the $2,900 and $2,920 resistance levels. Think of resistance levels as ceilings – prices often struggle to break through them. This upward movement is encouraging and suggests that buyers are stepping back into the market.

To understand the extent of this recovery, analysts often use Fibonacci retracement levels. In this case, the price retraced 23.6% of the recent drop from a high of $3,283 to a low of $2,832. This retracement level is a tool to gauge potential areas of support and resistance during a price swing. Furthermore, on the hourly chart for ETH/USD, a declining channel – which had been acting as a resistance – was also broken. This is another positive sign, indicating that the downward pressure might be easing.

Source : TradingView

Key Price Levels to Watch: Resistance and Support

As of now, Ethereum has managed to climb above $3,000 and is trading above the 100-hour simple moving average – more good news! However, it’s not out of the woods yet. There’s immediate resistance around $3,040. But the real challenge lies at the $3,060 level. Why is $3,060 so important?

- 50% Fibonacci Retracement: The $3,060 level coincides with the 50% Fibonacci retracement of the major drop from $3,283 to $2,832. This makes it a significant psychological and technical resistance point.

- Breaking $3,060: A decisive move and close above $3,060 could be the signal traders are waiting for. It might indicate the beginning of a new bullish (upward) trend for Ethereum.

What if ETH Breaks Above $3,060?

If Ethereum can confidently break and hold above $3,060, things could get interesting. Here’s what could happen next:

- Initial Targets: The price could initially target $3,100 and then $3,110.

- Further Ascent: Beyond these levels, we could see a push towards $3,250.

- Intermediate Resistance: Keep an eye on the $3,200 level as there might be some resistance here before reaching $3,250.

Essentially, breaking $3,060 could open the door for a more substantial upward movement, potentially bringing Ethereum back to higher price ranges.

What if ETH Fails to Break $3,060?

Cryptocurrency markets are known for their unpredictability. If Ethereum struggles to overcome the $3,050-$3,060 resistance zone, we might see a different scenario – a potential downward trend. Here’s what to watch for on the downside:

- Initial Support: The first support level to watch is around $2,980. Support levels act like floors, where buying interest can pick up and prevent further price declines.

- Key Support Zone: A more critical support zone is near $2,960, which is also close to the 100-hour simple moving average. This area is crucial because if broken, it could signal more significant downward pressure.

- Next Support Levels: If $2,960 fails to hold, the price might slide towards $2,920.

- Critical Support: The next major support is around $2,850. Breaking below this level could lead to further losses, potentially down to $2,680.

In a nutshell, if Ethereum can’t sustain an upward momentum past $3,060, we could see a retest of lower support levels, and possibly even a deeper correction.

Trading Strategy: Navigating ETH’s Price Action

So, how can you use this information to inform your trading decisions? Here are a few actionable insights:

| Scenario | Key Levels | Potential Action |

|---|---|---|

| Bullish Breakout (ETH breaks above $3,060) |

Resistance: $3,060, $3,100, $3,110, $3,200, $3,250 Support: $3,000 (previous resistance turned support) |

Consider a long position (buying) on a confirmed break above $3,060 with a stop-loss below $3,000. Target initial profits around $3,100-$3,110, and then reassess for further potential gains. |

| Bearish Rejection (ETH fails to break $3,060) |

Support: $2,980, $2,960, $2,920, $2,850, $2,680 Resistance: $3,040, $3,060 |

Consider a short position (selling) if ETH shows strong rejection at $3,060 and starts to decline. Set a stop-loss above $3,060. Target initial profits around $2,960-$2,980, and then monitor for further potential downside. |

| Consolidation Range (ETH trades between $2,960 and $3,060) |

Range: $2,960 – $3,060 | Exercise caution and wait for a clear breakout or breakdown from this range before taking a position. Range-bound trading strategies could be employed, but are riskier and require active monitoring. |

Disclaimer: This analysis is for informational purposes only and not financial advice. Trading cryptocurrencies involves significant risk. Always do your own research and consider your risk tolerance before making any trading decisions.

The Bigger Picture: Ethereum and the Crypto Market

Ethereum’s price movements don’t happen in isolation. They are influenced by a multitude of factors affecting the broader crypto market, including:

- Bitcoin’s Performance: Bitcoin often acts as a bellwether for the crypto market. When Bitcoin moves significantly, it usually impacts altcoins like Ethereum.

- Market Sentiment: Overall investor sentiment towards cryptocurrencies, driven by news, regulatory developments, and macroeconomic factors, plays a crucial role.

- Ethereum Network Updates: Developments within the Ethereum ecosystem, such as progress on Ethereum 2.0 (now known as the Merge and subsequent upgrades), can positively or negatively influence ETH’s price.

- DeFi and NFTs: The health and activity within the Decentralized Finance (DeFi) and Non-Fungible Token (NFT) spaces, which are largely built on Ethereum, can also affect ETH demand and price.

Keeping an eye on these broader market dynamics, alongside technical analysis, can provide a more comprehensive understanding of Ethereum’s price trajectory.

Conclusion: Staying Informed in the Crypto Rollercoaster

Ethereum’s price is currently at a crucial juncture. The battle between bulls and bears around the $3,060 resistance level will likely determine its short-term direction. Whether ETH breaks higher and resumes its upward trend, or faces rejection and revisits lower support levels remains to be seen.

For crypto enthusiasts and traders, staying informed, understanding key technical levels, and being aware of broader market influences are essential. The crypto market is dynamic and fast-paced, but with careful analysis and a sound strategy, you can navigate its ups and downs. Keep watching those charts, stay updated on market news, and trade wisely!

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.