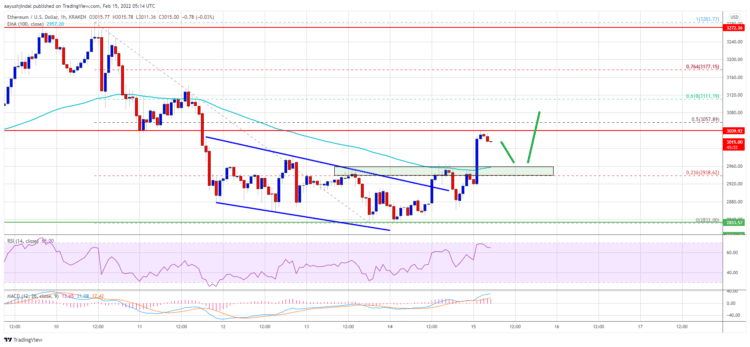

Below the $3,000 support zone and the 100 hourly simple moving average, Ethereum began a downward decline. However, near $2,830, ETH gained support and formed a base for a new advance.

The price rose over the barrier levels of $2,900 and $2,920. The crucial slide from the $3,283 swing high to the $2,832 low was retraced at a 23.6 percent Fib retracement level. On the hourly chart of ETH/USD, there was also a break over a strong declining channel with resistance above $2,920.

Source : TradingView

The price of Ether has risen above $3,000 and the 100 hourly simple moving average. Near the $3,040 level, there is instant resistance. The $3,060 level is the first big resistance.

It corresponds to the 50% Fib retracement level of the main slide from the swing high of $3,283 to the low of $2,832. A good close above $3,060 could signal the start of a new upward trend. In the above scenario, the price could rise above $3,100 and $3,110. Any further rises might push the price up to $3,250. Near the $3,200 level, an intermediate resistance exists.

If ethereum does not begin a new upward trend over $3,050 or $3,060, it may begin a new downward trend. On the downside, $2,980 serves as an initial support level.

Near the $2,960 mark and the 100 hourly simple moving average is the next important support. A break below the $2,960 mark on the downside might bring the price towards the $2,920 level. The next key support is near the $2,850 level, below which a further loss is possible. In the aforementioned scenario, the price may reach $2,680.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…