Ever wondered which countries are truly embracing the cryptocurrency revolution? Recent research has crunched the numbers, and the results might surprise you! While the United States is making headlines as a crypto-forward nation, the story is more nuanced than just one country dominating the scene. Let’s dive into the fascinating world of global cryptocurrency adoption and see who’s really leading the charge.

The United States Claims the Top Spot

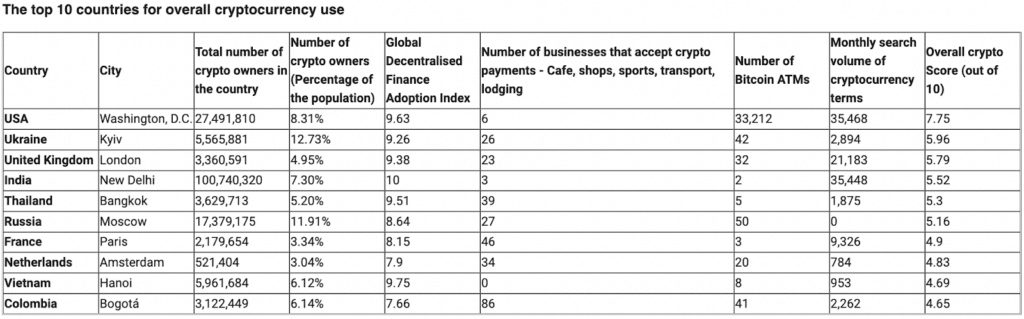

According to a comprehensive study by Merchant Machine, the United States emerges as the global leader in overall cryptocurrency adoption, boasting an impressive score of 7.75 out of 10. This score isn’t just pulled out of thin air; it’s based on a careful analysis of several key factors that paint a holistic picture of a nation’s crypto engagement.

Who Else is in the Crypto Race?

While the US takes the crown, the crypto landscape is diverse and dynamic. Trailing closely behind the United States is Ukraine, securing the second position with a score of 5.96. The United Kingdom rounds out the top three with a score of 5.79. This top three highlights an interesting mix of established economies and those where cryptocurrency plays a different, but equally important, role.

What Factors Determine Crypto Adoption?

So, what exactly goes into measuring a country’s crypto enthusiasm? The Merchant Machine study considered a range of crucial indicators, including:

- Number of Cryptocurrency Users: The sheer volume of individuals actively using cryptocurrencies within a nation.

- Worldwide Decentralized Finance (DeFi) Adoption Index: The level of engagement with decentralized financial platforms.

- Number of Merchants Accepting Cryptocurrencies: The prevalence of businesses accepting digital currencies for goods and services.

- Number of Bitcoin (BTC) ATMs: The accessibility of physical locations for buying and selling Bitcoin.

- Volume of Monthly Cryptocurrency Search Phrases: The level of public interest and curiosity surrounding cryptocurrencies, indicated by online searches.

Why Does the US Lead the Pack?

It’s perhaps not surprising that the United States scores highly. Factors contributing to their leading position include:

- Economic Powerhouse: The sheer size and strength of the US economy provide a fertile ground for crypto innovation and investment.

- Developed Crypto Economy: The US boasts a mature and well-established cryptocurrency ecosystem, with numerous exchanges, businesses, and regulatory frameworks (though still evolving).

The Ukraine Story: A Different Kind of Adoption

Now, here’s where things get really interesting. While the US and UK’s high rankings might seem expected, Ukraine’s second-place position raises an important question: What’s driving crypto adoption in emerging economies?

The report highlights that despite having the lowest GDP and GNI per capita among the top contenders, Ukraine’s high score reflects a broader trend in emerging economies. Cryptocurrency isn’t just about speculation or investment here; it often serves a more fundamental purpose.

Cryptocurrency as a Safe Haven

One of the key drivers of crypto adoption in Ukraine is the role it plays as a store of value. With a population ownership rate of 12.73%, Ukraine actually tops the list for individual crypto ownership among the top ten nations. This high ownership rate is largely attributed to:

- Currency Devaluation: In economies facing instability and devaluation of their native currencies, cryptocurrencies can offer a more stable alternative for preserving wealth.

In essence, for many in Ukraine, cryptocurrency isn’t just a speculative asset; it’s a practical tool for protecting their finances against economic headwinds.

Key Takeaways: What Does This Mean for the Crypto Future?

This research offers valuable insights into the global crypto landscape:

- Different Drivers, Same Destination: While developed economies like the US focus on innovation and investment, emerging economies often see crypto as a financial lifeline.

- Adoption is Multifaceted: Crypto adoption isn’t a one-size-fits-all phenomenon. It’s influenced by economic factors, technological infrastructure, and individual needs.

- Growth Potential Remains Strong: The continued rise of crypto adoption across diverse nations signals a strong future for digital currencies.

Looking Ahead

The global cryptocurrency landscape is constantly evolving. Understanding the different factors driving adoption in various countries is crucial for navigating this exciting space. Whether it’s the robust infrastructure of the US or the necessity-driven adoption in Ukraine, the story of cryptocurrency is a global one, with many more chapters yet to be written.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.