Is Axie Infinity making a comeback? If you’ve been keeping an eye on the play-to-earn (P2E) crypto gaming space, you’ve probably heard of Axie Infinity. Once a dominant force, it’s been navigating the evolving landscape of blockchain gaming. But recent on-chain data suggests something interesting is happening – demand for Axie Infinity is on the rise again! Let’s dive into the details and explore what’s fueling this resurgence.

Axie Infinity Network Buzzing Again?

According to data from DappRadar, a leading platform for tracking decentralized applications (dApps), Axie Infinity has witnessed a significant uptick in network activity over the past 30 days. This isn’t just idle chatter; the numbers speak for themselves:

- Active Wallets Soar: The number of unique active wallets interacting with the Axie Infinity dApp jumped by a notable 30% in the last month.

- Transaction Volume Jumps: This increased user activity translated into a 19% rise in the total number of transactions completed on the platform, reaching a staggering 1.41 million transactions.

In simpler terms, more players are engaging with Axie Infinity, and they’re actively participating in the game’s ecosystem. This surge in activity indicates a renewed interest in the P2E game.

View Axie Infinity data on DappRadar

What’s Driving This Renewed Interest?

So, what’s behind this surge in Axie Infinity’s network activity? The article points to several ecosystem developments as potential catalysts, particularly a strategic collaboration:

- Partnership with Act Games: Sky Mavis, the developers behind Axie Infinity, joined forces with Korean gaming giant Act Games. This collaboration aims to bring a range of Japanese Web2 games onto the Ronin blockchain, the network powering Axie Infinity.

This partnership could be a game-changer. Integrating established Web2 games into the Ronin ecosystem could attract a wave of new users eager to explore Axie Infinity and the broader Ronin network. It’s like opening the doors to a wider audience and showcasing the potential of blockchain gaming.

Read Also: Axie Infinity Unveils NFT Monetization Solution, Official Merchandise

AXS Token: Holding Strong Amidst Activity Spike

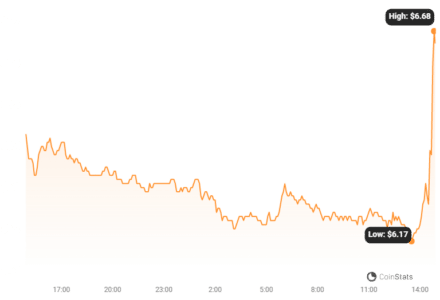

The native token of the Axie Infinity ecosystem, AXS, has also shown resilience and positive momentum alongside the increased network activity. Let’s take a closer look at its performance:

- Price Surge: Over the last month, AXS experienced a price hike of approximately 35%, according to data from Coinstats.

- Accumulation Trend: Despite price consolidation in November, market participants have continued to accumulate AXS, indicating strong underlying interest.

This accumulation trend suggests that investors and players alike are optimistic about Axie Infinity’s future prospects. But what do the technical indicators tell us?

AXS Price Analysis: Bulls in Control?

Analyzing the daily chart of AXS, key momentum indicators offer insights into the token’s strength:

- Relative Strength Index (RSI): At 56.45, the RSI is above the center line (50), suggesting buying momentum is present.

- Money Flow Index (MFI): With an MFI of 63.48, the token is in the overbought territory, but still indicates strong buying pressure.

- Chaikin Money Flow (CMF): The CMF, at 0.04 and in an uptrend, signals a net inflow of liquidity into AXS. While there’s been a slight dip due to profit-taking, the CMF remaining positive confirms that buyers are still dominant.

These technical indicators collectively paint a picture of sustained buying pressure and market dominance by the bulls for AXS. While some profit-taking is natural, the overall trend remains positive.

What Does This Mean for Axie Infinity’s Future?

The recent surge in network activity and positive AXS price action are encouraging signs for Axie Infinity. The partnership with Act Games, coupled with ongoing developments within the ecosystem, could be attracting new users and reigniting interest in the game.

However, it’s crucial to remember that the crypto market is dynamic and volatile. While the current data is positive, continued growth and sustainability will depend on various factors, including:

- Successful Integration of Web2 Games: The execution of the Act Games partnership and the appeal of the integrated games will be key.

- Ecosystem Development: Ongoing updates, new features, and community engagement within Axie Infinity will be crucial for player retention and attraction.

- Broader Market Conditions: The overall health of the crypto market and investor sentiment towards P2E games will also play a significant role.

In Conclusion: Is Axie Infinity Poised for a Comeback?

The data suggests that Axie Infinity is indeed experiencing a resurgence in demand and activity. The network is buzzing, AXS is showing strength, and strategic partnerships are in motion. While the future remains uncertain, these are definitely positive signals for the once-leading P2E game. Keep an eye on Axie Infinity – it might just be gearing up for its next chapter!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.