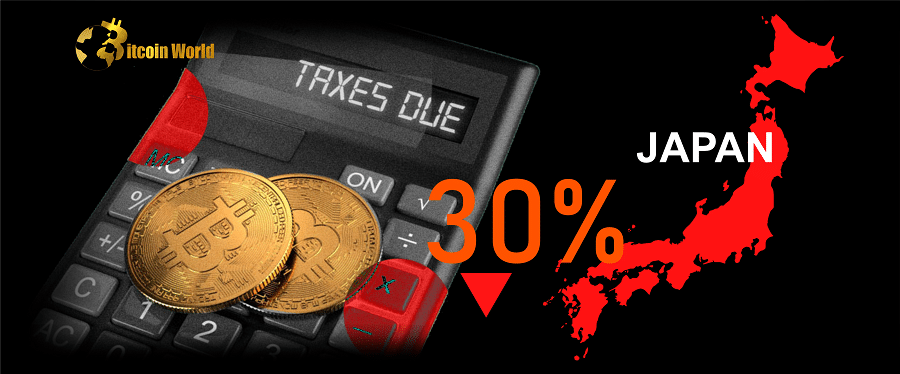

Currently, Japanese crypto issuers must pay a 30% corporate tax rate on their holdings, even if they haven’t made a profit through a sale.

The Japanese government plans to relax tax requirements for domestic crypto firms as part of its efforts to stimulate growth in the domestic finance and technology sectors.

At the moment, Japanese companies that issue cryptocurrency must pay a 30% corporate tax rate on their holdings, even if they haven’t made a profit through a sale. As a result, a number of domestically founded crypto/blockchain firms and talent have reportedly chosen to establish themselves elsewhere in recent years.

The tax committee of Japan’s ruling party, the Liberal Democratic Party (LDP), met on December 15 and approved a proposal — first tabled in August — that eliminates the requirement for crypto companies to pay taxes on paper gains from tokens issued and held.

The softer crypto tax rules are expected to be submitted to parliament in January and to take effect on April 1 for Japan’s next fiscal year.

Akihisa Shiozaki, an LDP lawmaker and member of the party’s Web3 policy office, told Bloomberg on December 15 that “this is a very big step forward,” adding that “it will become easier for various companies to do business that involves issuing tokens.”

Despite the FTX disaster, Prime Minister Fumio Kishida stated in October that NFTs, blockchain, and the Metaverse will all play important roles in Japan’s digital transformation. As an example, the PM cited the digitization of national identity cards.

The Japan Virtual and Crypto Assets Exchange Association also announced plans in October to relax the stringent screening process for listing new tokens on exchanges, something Kishida had requested from the self-regulatory organization in June.