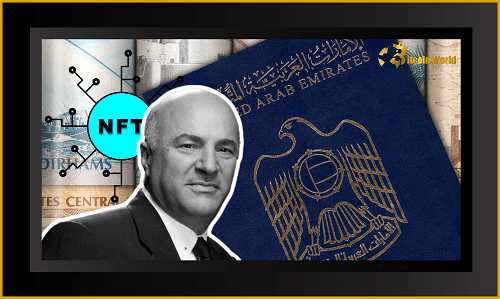

Shark Tank’s very own Kevin O’Leary is diving deeper into the world of digital assets! Fresh off becoming a citizen of the United Arab Emirates, O’Leary is gearing up to launch Cipher, an investment fund laser-focused on the exciting potential of Web 3.0. Intrigued? You should be. Let’s break down why this move is making waves in the crypto sphere.

Why the UAE Move? Unlocking Web3 Opportunities

So, why did Mr. Wonderful decide to call the UAE home? According to O’Leary himself, it’s all about freedom – the freedom to operate within a jurisdiction that’s actively embracing the future of finance. The UAE has become a magnet for major crypto players like FTX, Binance, and Crypto.com, signaling a forward-thinking approach that appeals to investors like O’Leary. Think of it as setting up shop where the innovation is happening.

Cipher: What’s the Focus?

While details are still emerging, Cipher will be squarely aimed at the burgeoning Web3 landscape. But what exactly is Web3? In simple terms, it’s the next evolution of the internet, characterized by decentralization, blockchain technology, and user ownership. Think of a more democratic and transparent internet where users have greater control over their data and digital assets. O’Leary’s fund will likely target promising startups and projects building the infrastructure and applications of this new web era.

O’Leary’s Crypto Journey: From Skeptic to Advocate

It’s worth noting that O’Leary hasn’t always been a crypto enthusiast. He’s famously evolved his stance over time, and now stands as a vocal supporter of the technology. His involvement as a spokesperson for crypto exchange FTX and an investor in Circle, the company behind the USDC stablecoin, speaks volumes about his conviction in the long-term potential of digital assets. He even played a key role in the Converge22 conference, a significant event for the crypto industry.

Crypto Market Turbulence: Opportunity in the Downturn?

The crypto market hasn’t exactly been smooth sailing lately. The dramatic collapse of Terra-LUNA served as a stark reminder of the risks involved and has prompted global regulators to take a closer look. However, O’Leary sees this period of consolidation as a positive sign. He believes that the resilience of the remaining key players demonstrates their strength and ability to attract further investment. It’s a ‘survival of the fittest’ scenario, and O’Leary is betting on the survivors.

Key Takeaways from O’Leary’s Web3 Bet:

- Strategic Location: O’Leary’s move to the UAE highlights the growing importance of regulatory clarity and a supportive environment for crypto innovation.

- Web3 Focus: Cipher signals a strong belief in the future of a decentralized internet and the opportunities it presents.

- Market Resilience: Despite recent downturns, O’Leary sees strength in the remaining crypto players.

- Continued Advocacy: His ongoing involvement with key industry players underscores his commitment to the crypto space.

What Does This Mean for You?

While you might not be launching your own Web3 fund anytime soon, O’Leary’s move offers valuable insights:

- Pay attention to regulatory developments: Where governments are embracing crypto can indicate future hubs of innovation.

- Explore Web3: Understand the potential of decentralized applications, NFTs, and the metaverse.

- Consider the long-term: Despite market volatility, experienced investors like O’Leary see long-term value in the underlying technology.

The Future of Web3: Are You Ready?

Kevin O’Leary’s investment in Cipher is a significant endorsement of the Web3 vision. It highlights the growing institutional interest in this space and the potential for transformative change across various industries. Whether you’re a seasoned crypto investor or simply curious about the future of the internet, O’Leary’s latest venture is a clear signal that Web3 is a force to be reckoned with. The journey is just beginning, and it will be fascinating to see how Cipher and other initiatives shape the landscape of this exciting new frontier.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.