Reliable Indicator Points to Positive Trend Reversal

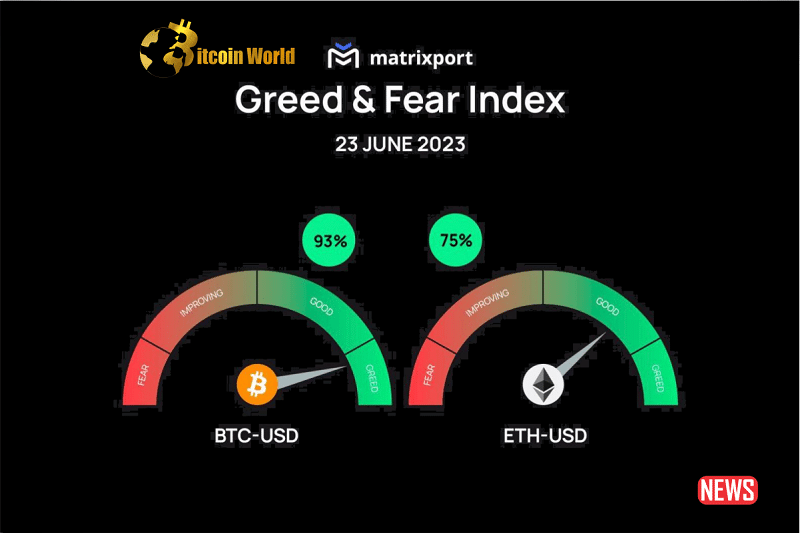

In the dynamic world of cryptocurrencies, reliable indicators are prized possessions for traders seeking insights into market sentiment and potential price movements. One such coveted tool is Matrixport’s proprietary Bitcoin Greed and Fear Index, renowned for its historical accuracy in marking trend reversals. Recent data from this index suggests a potential bull revival for Bitcoin ($BTC), adding a new layer of anticipation to the market.

Greed and Fear Index: Navigating Bitcoin’s Emotional Terrain

Matrixport’s Greed and Fear Index is a barometer of investor sentiment, providing a numerical representation of emotions in the crypto market. A reading above 90% signals greed or excessive optimism, often associated with market tops, while a reading below 10% reflects extreme fear or pessimism, indicative of market bottoms. These insights are of immense value as they offer a glimpse into the psychological factors driving price action.

The most recent data update on the Greed and Fear Index unveils a significant shift. After sliding from above 90% to 30%, the index has rebounded to 60%, highlighting a noteworthy shift in market sentiment. This turnaround suggests a potential end to July’s downward trajectory and paves the way for renewed optimism.

Markus Thielen, the Head of Research and Strategy at Matrixport, provided valuable insight into this shift. He indicated, “The index appears to have bottomed out as the daily signal (grey) is projecting upside pressure. After four weeks of consolidation, this indicator is tactically bullish and Bitcoin prices could resume the uptrend.” This analysis underscores the potential for positive price movement ahead.

Historical data reveals an interesting correlation between the index’s tops and bottoms and Bitcoin’s price reversals. This alignment with the 21-day Simple Moving Average (SMA) of the index has historically coincided with shifts in Bitcoin’s market trajectory. The 21-day SMA displays signs of bottoming out, reinforcing the case for an impending surge in Bitcoin’s value.

Bitcoin, often a captivating subject of market scrutiny, has recently displayed a period of price stagnation, oscillating between the $28,000 and $30,000 range for over two weeks. This stability has unfolded amidst market volatility and anticipation surrounding potential Federal Reserve rate cuts in the coming year.

As the cryptocurrency landscape evolves, one of the crucial catalysts for Bitcoin’s price volatility rests with the Securities and Exchange Commission (SEC). Awaiting a pivotal decision, analysts eye the SEC’s pronouncement on Ark Invest’s spot Bitcoin ETF application, scheduled for August 13th. While this date falls on a Sunday, market watchers speculate that the SEC might unveil its decision on the preceding Friday.

Matrixport’s Greed and Fear Index is a compelling testament to the psychological underpinnings of the crypto market. With its recent indications of a bullish revival in Bitcoin, traders and enthusiasts find themselves on the edge of anticipation, poised to witness how market sentiment translates into price movements. Amidst regulatory developments and shifting emotions, the stage is set for a potential reawakening of Bitcoin’s upward trajectory.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.