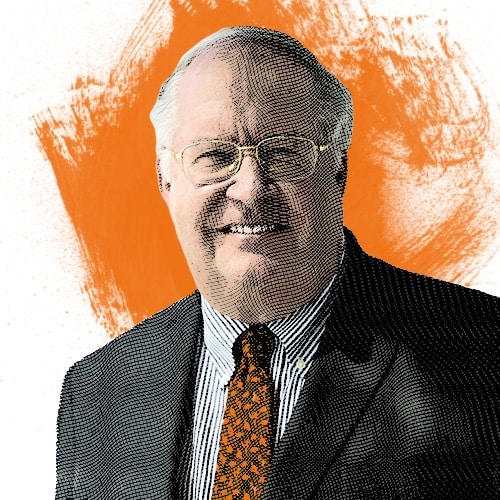

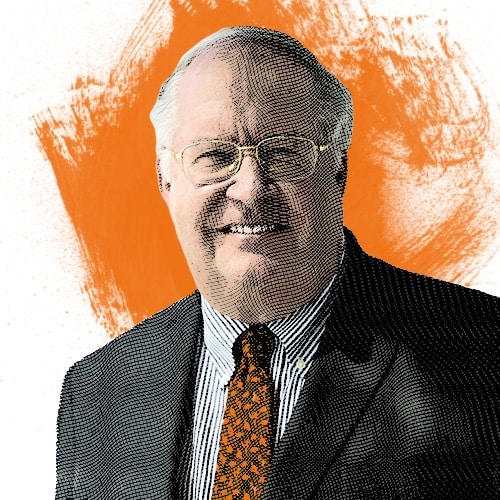

An asset management company, Miller Value Funds, with $3.5 billion in assets under management, has filed with the SEC to fund Grayscale Bitcoin Trust. Bill Miller, a veteran investor and asset manager, runs the Miller Value Partners. Moreover, he has invested in Bitcoin for quite some time now. However, this would be the first instance of him running a bitcoin portfolio for a publicly traded fund. The official filing exhibits that the company is contemplating a 15% exposure to Bitcoin through the GBTC trust fund. It also incorporated that it would cease purchasing the cryptocurrency after they reach the cap.

However, it is not clear if Miller Value Funds intends to sell Bitcoin after its portfolio reaches the 15% mark. Although the firm did simplify, it would not add any new Bitcoin if their current purchase breaches 15% of their portfolio. The disclosure, involved in a filing with the U.S. SEC, appears after Bill Miller wrote an extensive exploration and defense of Bitcoin in a letter to investors.

Miller Value Funds holds $2.24 Billion in AUM.

As per the Miller Value Funds’ website, the fund had $2.24 billion in AUM as of Dec. 31, 2020. Its most extensive holdings involve Uber, Fartech Ltd, DXC Technology Co., and Amazon. Furthermore, Bitcoin has been rising as the favorite amongst institution players as the new hedge upon inflation. MicroStrategy, along with ten other publicly traded companies, commenced combining Bitcoin to their company sheets.

MicroStrategy is recently leading the institutional Bitcoin exposure and has invested $1.5 billion in the foremost cryptocurrency. The CEO of the firm, Michael Saylor, announced that NYDIG’s Ross Stevens notified him about a potential $25 billion institutional inflow into Bitcoin by the end of the year. Conclusively, Miller Value Fund’s 15% display to Bitcoin only makes that point more credible as more public companies are recently contemplating investing in Bitcoin. Moreover, it has developed as the growing alternative for institutions as the new hedging asset and store of value.

Follow BitcoinWorld for the latest updates.