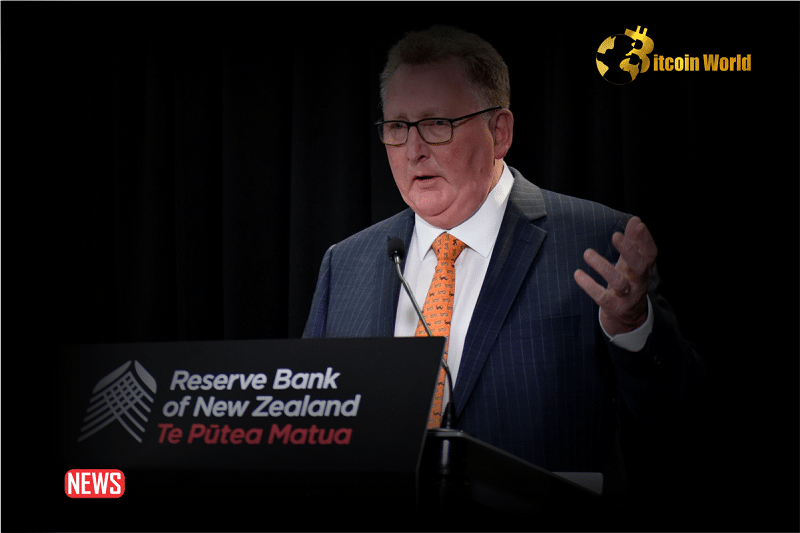

Are stablecoins really that stable? The Governor of New Zealand’s central bank, Adrian Orr, isn’t so sure. He’s raising a red flag about these digital assets, questioning their reliability and potential impact on the global financial system. Let’s dive into why he’s so concerned.

Why the New Zealand Central Bank Governor Calls Stablecoins ‘Oxymorons’

- Perceived Stability vs. Reality: Orr argues that the term ‘stablecoin’ is misleading. Their stability hinges entirely on the issuer’s financial health and balance sheet.

- Not a Substitute for Fiat: He emphasizes that stablecoins, despite being pegged to fiat currencies, can’t replace real government-backed money.

- Risk of Instability: Unmonitored stablecoins could introduce instability into the real-world financial system, especially during economic challenges.

Orr didn’t mince words during a parliamentary committee session in Wellington. He stated that the stability of stablecoins is one of the “biggest misnomers”. He believes their supposed stability is a marketing gimmick that hides underlying risks.

The Core Concerns Explained

So, what exactly are these risks? Here’s a breakdown:

- Issuer Dependency: The value of a stablecoin is only as good as the company backing it. If the issuer faces financial trouble, the stablecoin’s value could plummet.

- Reserve Vulnerability: Stablecoins rely on reserves to maintain their peg. However, these reserves can be vulnerable to market disruptions.

- Systemic Risk: If stablecoins become widely used, their failure could have a ripple effect throughout the entire financial system.

See Also: ‘Almost All Financial Scams Are Now Crypto-themed’ – Russian Central Bank

Bitcoin’s Limitations as a Currency: Another Red Flag

Orr’s skepticism extends beyond stablecoins. He also questioned Bitcoin’s viability as a mainstream currency.

Why Bitcoin Doesn’t Cut It, According to Orr:

- Not a Reliable Means of Exchange: Bitcoin’s price volatility makes it impractical for everyday transactions.

- Unstable Store of Value: Its value fluctuates wildly, making it a risky asset to hold for the long term.

- Not a Unit of Account: Few businesses price their goods and services in Bitcoin.

He argues that Bitcoin lacks the fundamental characteristics of a true currency. While it might have alternative uses, it can’t replace traditional central bank money.

See Also: No Crypto Ad In Super Bowl But Jack Dorsey Spotted In ‘Satoshi’ Shirt

The Importance of Fiat Currencies

Orr emphasized the crucial role of fiat currencies like the New Zealand dollar. Their credibility comes from legislative backing and the oversight of reputable institutions like independent central banks.

Central banks play a vital role in maintaining low and stable inflation, ensuring the reliability of fiat currencies.

Key Takeaways

- Stablecoins aren’t as stable as their name suggests.

- Their value depends on the financial health of the issuer.

- Bitcoin doesn’t fulfill the core functions of a currency.

- Fiat currencies are backed by legislation and reputable institutions.

In Conclusion: Proceed with Caution

Adrian Orr’s warnings serve as a reminder to approach stablecoins and cryptocurrencies with caution. While these digital assets offer potential benefits, they also carry significant risks. It’s crucial to understand these risks before investing or using them.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.