Heads up, crypto enthusiasts! Major exchange OKX has just dropped a bombshell: they’re delisting several privacy-focused cryptocurrencies, including Monero (XMR) and Zcash (ZEC). If you’re holding these tokens on OKX, you need to pay attention. Let’s dive into what’s happening and why this could be a significant shift in the crypto landscape.

OKX Announces Delisting of Privacy Tokens: What Tokens are Affected?

On December 29th, OKX officially announced the removal of trading pairs for a range of privacy-centric cryptocurrencies. This isn’t just a minor tweak; it’s a significant move impacting prominent names in the privacy coin space. Here’s a breakdown of the tokens facing the delisting axe:

- Monero (XMR): Known for its strong privacy features, Monero is a leading privacy coin.

- Zcash (ZEC): Another well-known privacy coin utilizing advanced cryptography for enhanced transaction privacy.

- Dash (DASH): While not solely a privacy coin, Dash offers optional privacy features that are now seemingly under scrutiny.

- Horizen (ZEN): Similar to Dash, Horizen provides privacy options alongside its core functionalities.

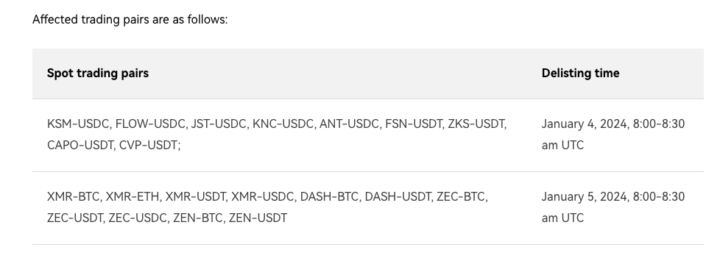

In total, OKX will remove 11 trading pairs involving these tokens. Here’s a look at the announcement:

The delisting is scheduled to take effect on January 5, 2024. Mark your calendars if you’re trading these pairs on OKX!

Why is OKX Delisting Privacy Tokens?

OKX states the decision is part of their routine monitoring to maintain a “robust spot trading environment.” They emphasize regular reviews of listed trading pairs and their qualifications. According to their official announcement, the delisting is:

“In order to maintain a robust spot trading environment, we constantly monitor the performance of all listed trading pairs and review their listing qualifications on a regular basis,”

Furthermore, OKX mentioned that the decision was influenced by “feedback from users” and aligns with their token delisting guidelines. However, the exact nature of user feedback or specific guideline violations remains unclear. This move follows a similar action by Binance, who also recently announced the delisting of 11 cryptocurrency trading pairs.

See Also: Binance To Delist 11 Cryptocurrency Trading Pairs On December 29

The Bigger Picture: Regulatory Pressure and Privacy Coins

While OKX cites user feedback and trading environment maintenance, the delisting of privacy tokens likely points to a larger trend: increasing regulatory scrutiny on privacy-focused cryptocurrencies.

Privacy coins, by their nature, make transactions harder to trace, which can raise concerns for regulators focused on anti-money laundering (AML) and combating the financing of terrorism (CFT). Exchanges operating in a global regulatory landscape are often under pressure to comply with varying and sometimes conflicting regulations.

Here’s why regulatory pressure is likely a key factor:

- Compliance Concerns: Exchanges must adhere to KYC (Know Your Customer) and AML regulations in various jurisdictions. Privacy coins can complicate these compliance efforts.

- Increased Scrutiny: Global regulatory bodies are increasingly focusing on the crypto space, with privacy coins being a particular point of interest.

- Risk Mitigation: Delisting privacy tokens can be seen as a proactive step by exchanges to mitigate potential regulatory risks and maintain a compliant platform.

Impact on the Crypto Market and Privacy Coins

OKX is a major player in the crypto exchange world, processing billions in trades daily. According to data from CoinGecko, OKX sees daily trading volumes exceeding $3 billion. Delisting privacy tokens on such a significant exchange can have several implications:

- Reduced Liquidity: Delisting on a major exchange typically leads to reduced liquidity for the affected tokens, at least on that specific platform.

- Price Impact: News of delisting can sometimes negatively impact the price of the tokens, although market reactions can vary.

- Broader Trend? The decisions by both OKX and Binance to delist privacy tokens could signal a broader trend among exchanges, potentially limiting access to these coins on centralized platforms.

- Focus on Regulation: This event further highlights the ongoing tension between the crypto industry’s push for privacy and the increasing regulatory demands for transparency.

As of now, OKX lists a substantial number of trading pairs, including:

- 4 Monero (XMR) trading pairs

- 4 DASH pairs

- 3 Zcash (ZEC) pairs

- 4 Horizen (ZEN) pairs

All of these are slated for removal on January 5th, 2024.

What Should Users Do? Actionable Insights

If you are currently trading or holding Monero, Zcash, Dash, or Horizen on OKX, here’s what you should consider:

- Withdraw Your Tokens: If you wish to continue holding these tokens, withdraw them from OKX before the delisting date. You can transfer them to a private wallet or another exchange that still supports them.

- Adjust Trading Strategies: If you actively trade these pairs on OKX, adjust your strategies and close out any positions before January 5th.

- Stay Informed: Keep an eye on announcements from other exchanges and regulatory developments regarding privacy coins.

- Consider Decentralized Exchanges (DEXs): For continued trading of privacy coins, explore decentralized exchanges which may offer more options, though potentially with different risks and complexities.

In Conclusion: Privacy in Crypto Faces New Challenges

OKX’s decision to delist Monero, Zcash, and other privacy tokens marks a significant moment for the crypto industry. While the exchange cites routine reviews, the move strongly suggests the increasing pressure on privacy-focused cryptocurrencies due to regulatory concerns. This delisting, coupled with similar actions from other exchanges, could reshape the accessibility and trading landscape for privacy coins. It underscores the ongoing dialogue and tension between the core principles of crypto privacy and the evolving regulatory framework governing the digital asset space. For users of privacy coins, staying informed and adaptable will be crucial in navigating this changing environment.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.