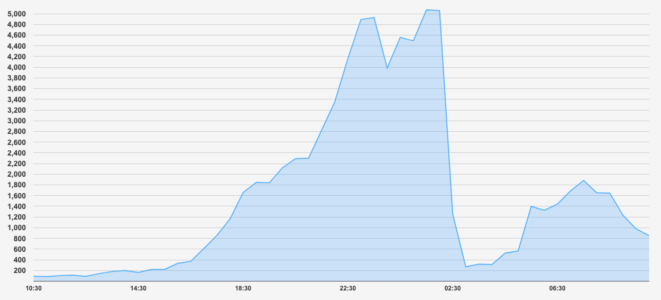

Hold onto your MATIC! Things got a little wild on the Polygon network recently. If you’re in the crypto space, you know gas fees are just part of the game, but even seasoned Polygon users were surprised to see them skyrocket. We’re talking a massive 1000% jump, hitting a peak of $0.10! What caused this sudden surge? Buckle up, because it’s all thanks to a new token in town called POLS, inspired by the Bitcoin Ordinals craze.

What Exactly Happened with Polygon Gas Fees?

Imagine suddenly finding yourself in a traffic jam on a highway that’s usually smooth sailing. That’s essentially what happened to the Polygon network. For a brief period, the typically low gas fees, a major perk of using Polygon, shot up dramatically. To put it in perspective:

- Gas fees on the Polygon network jumped by over 1000%.

- They reached as high as $0.10 per transaction.

- This spike was triggered by a massive influx of users eager to mint a new token called POLS.

Think of it like everyone rushing to buy the latest must-have item all at once – the network gets congested, and to get your transaction processed, you have to pay a higher “fee” to cut through the line.

The POLS Token: The Catalyst for the Gas Fee Frenzy

So, what is this POLS token that caused such a stir? It seems to be the main culprit behind the network congestion and the gas fee spike. Even Polygon’s founder, Sandeep Nailwal, expressed surprise at the sudden activity. In a tweet, he hinted that a new Polygon-based NFT collection might be the reason.

Something is brewing on @0xPolygon

Gas price just jumped significantly. May be some new NFT collection is getting launched? pic.twitter.com/sK9mDIa6Qk

— Sandeep Nailwal 🇮🇳 (@sandeepnailwal) November 16, 2023

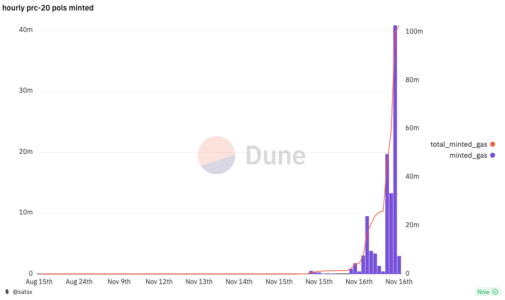

However, the real reason appears to be the intense enthusiasm for minting the POLS token. This token is built on a protocol called PRC-20. Sound familiar? It should! PRC-20 is designed to work similarly to Bitcoin’s BRC-20 token standard, which itself is inspired by Ordinals. Ordinals allow for inscribing data, like NFTs, directly onto individual satoshis (the smallest unit of Bitcoin).

Read Also: Circle Announces A v2.2 Upgrade For USDC And EURC, Reduces Gas Fees By About 7%

MATIC Tokens Fueling the POLS Minting Mania

Data from Dune Analytics reveals the sheer scale of this minting frenzy. During the POLS rush, over 102 million MATIC tokens were consumed as gas! At current prices, that’s a whopping $86 million worth of MATIC. That’s a lot of gas for a lot of transactions! It clearly shows the immense demand to get in on the POLS action.

POLS: Still Early Days

Interestingly, despite the hype and gas fee surge, data from EVM (Ethereum Virtual Machine data provider) indicates that we’re still in the early stages of POLS adoption. As of now:

- Only 8.7% of the total POLS supply has been minted.

- Just over 18,100 unique owners have claimed the token.

This suggests that there might be more POLS minting activity to come, potentially leading to further fluctuations in Polygon gas fees in the future.

Gas Fees Back to Normal (For Now)

Good news for everyday Polygon users! As of the time of writing, gas fees have thankfully returned to more typical levels, hovering around 882 gwei. For those new to gas fees, gwei is a unit of measurement on blockchains, and 1 gwei is a tiny fraction of MATIC (0.000000001 MATIC to be precise). So, 882 gwei is a far cry from the peak we saw during the POLS frenzy.

Echoes of Bitcoin Ordinals?

This whole situation might sound familiar to those who followed the Bitcoin space earlier this year. Remember the Ordinals protocol launch on Bitcoin? It allowed people to mint NFTs directly on the Bitcoin blockchain, leading to a similar surge in network activity and transaction fees. Bitcoin fees reached levels not seen since April 2021! This caused quite a stir, with some Bitcoin purists like Samson Mow and Adam Back criticizing Ordinals and BRC-20 tokens as wasteful.

Key Takeaways and What to Watch For

This Polygon gas fee spike serves as a reminder of a few important things in the crypto world:

- Demand can be unpredictable: The sudden interest in POLS and PRC-20 tokens caught many by surprise, highlighting how quickly things can change in crypto.

- Network congestion is real: Even Layer-2 solutions like Polygon aren’t immune to network congestion when there’s a surge in demand.

- Ordinals-inspired tokens are gaining traction: The POLS example shows that the Ordinals concept is expanding beyond Bitcoin and finding its way into other ecosystems.

- Keep an eye on gas fees: If you’re actively using Polygon or other blockchains, it’s always wise to monitor gas fees, especially when new tokens or projects are launching.

In Conclusion: A Momentary Surge, But Lessons Learned

The Polygon gas fee surge driven by the POLS token was a short-lived event, but it offered valuable insights into network dynamics and the evolving trends in the crypto space. It demonstrates the power of new token standards like PRC-20 and the potential for Ordinals-inspired projects to create significant, albeit temporary, shifts in network activity. As the crypto landscape continues to innovate and evolve, expect more such instances of rapid adoption and network adjustments. Staying informed and adaptable is key to navigating this exciting and ever-changing world of blockchain technology.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.