Feeling the crypto market jitters? Let’s dive into the recent price action of Bitcoin Cash (BCH). While the broader crypto market experiences its usual ups and downs, BCH is making headlines with a notable surge in the last 24 hours. Bucking the trend of the past week, Bitcoin Cash has experienced a 4.15% increase, pushing its price to $444.56. This is a welcome change from the previous week’s slight downturn of 2.0%, where it slid from $452.54 to its current level.

For context, remember that Bitcoin Cash once reached an all-time high of $3,785.82. While current prices are a far cry from that peak, any positive movement is something crypto enthusiasts are keen to analyze.

See Also: Price Analysis: Stellar (XLM) Price Increased More Than 12% Within 24 Hours

Decoding the Price Swings: Daily vs. Weekly Performance

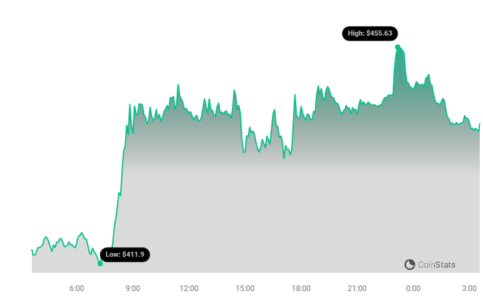

To better understand what’s happening with BCH, let’s break down its price movement and volatility. The charts below give us a visual snapshot, comparing the last 24 hours against the past week.

Notice those gray bands in the charts? Those are Bollinger Bands, a handy tool for gauging volatility. Essentially, the wider the bands, the more price fluctuations we’re seeing. A wider gray area signals higher volatility, meaning the price is swinging more dramatically.

Is BCH Volatility on the Rise?

Analyzing the Bollinger Bands can offer clues about Bitcoin Cash’s risk profile. Are the bands widening significantly in the daily chart compared to the weekly chart? This could suggest that while we’re seeing a short-term price pump, it might be accompanied by increased price volatility. Traders often use volatility indicators like Bollinger Bands to assess potential risk and plan their strategies.

Digging Deeper: Trading Volume and Circulating Supply

Price movements are only one piece of the puzzle. To get a more complete picture of Bitcoin Cash’s current market health, we need to look at trading volume and circulating supply.

Interestingly, while the price is up in the last 24 hours, the trading volume for BCH has actually decreased by a significant 46.0% over the past week. Alongside this, the circulating supply of BCH has also slightly decreased by 0.12% during the same period.

What Does This Mean for BCH?

Let’s break down these figures:

- Decreased Trading Volume: A drop in trading volume, especially alongside a price increase, can sometimes be interpreted as a less enthusiastic rally. It might suggest that fewer traders are actively participating, and the price movement could be more susceptible to shifts in sentiment.

- Slight Decrease in Circulating Supply: A minor decrease in circulating supply is less impactful in the short term, but it’s worth noting. Currently, the circulating supply of BCH is 19.67 million coins, representing approximately 93.65% of its maximum supply of 21.00 million.

According to the latest data, Bitcoin Cash currently holds the #20 rank in market capitalization, with a market cap of $8.76 billion. This ranking places it among the established cryptocurrencies in the market.

Key Takeaways and What to Watch For

- Short-Term Positive Momentum: Bitcoin Cash has shown a positive price movement in the last 24 hours, breaking away from its recent weekly downtrend.

- Volatility Watch: Keep an eye on volatility indicators like Bollinger Bands to assess the risk associated with BCH trading.

- Trading Volume is Crucial: Monitor the trading volume in the coming days. A sustained price increase accompanied by rising volume would be a stronger bullish signal.

- Market Sentiment: Broader market sentiment and Bitcoin’s price action will likely continue to influence BCH.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial or trading advice. Cryptocurrency investments are inherently risky. Bitcoinworld.co.in is not responsible for any investment decisions made based on this information. We strongly advise conducting thorough independent research and seeking advice from a qualified financial advisor before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.