Buckle up, crypto enthusiasts! The decentralized finance (DeFi) space is buzzing with a potentially game-changing proposal from none other than MakerDAO, the powerhouse behind the DAI stablecoin. Imagine a world where MakerDAO’s governance token, MKR, takes a backseat, making way for a new contender – stkMKR. Sounds like a crypto plot twist, right? Let’s dive into the heart of this proposal and explore what it could mean for the future of MakerDAO and the wider crypto market.

What’s the Buzz About stkMKR?

On March 14th, a proposal landed on the MakerDAO forum, courtesy of community leader ‘monet-supply’. This wasn’t just any suggestion; it was a blueprint for a completely revamped token economic system. The core idea? To potentially replace MKR, the current governance token, with a brand-new token called stkMKR. Think of it as a token evolution! The initial reaction? Overwhelmingly positive, with the community quickly jumping into discussions about the technical nuances of this innovative solution.

But hold on, this isn’t a done deal yet. For stkMKR to become a reality, it needs to be formalized as a MIP (Maker Improvement Proposal) and then face the ultimate test – a full governance vote by MKR holders. These votes typically span around two weeks, so keep your eyes peeled for updates!

Why the Tokenomics Shake-Up?

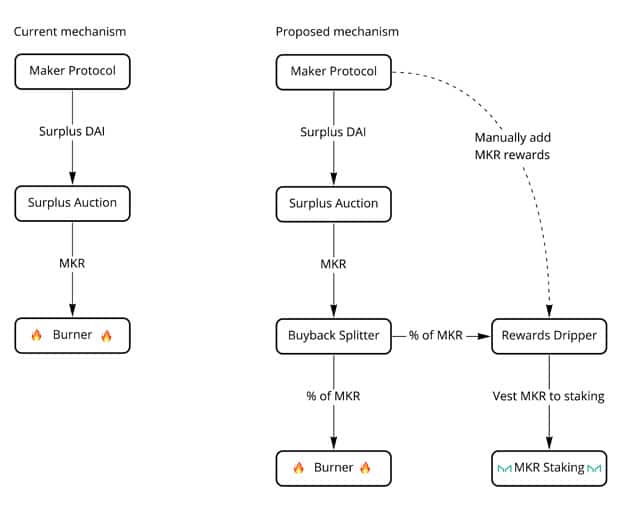

So, what’s driving this potential seismic shift? According to ‘monet-supply’, the current tokenomics model, built on a ‘buyback and burn’ mechanism, isn’t as efficient or effective as it could be. Let’s break down the pain points:

- Lack of Targeted Incentives: The existing buyback and burn system essentially distributes rewards broadly to all MKR holders, potentially missing opportunities for more focused incentives.

- ‘Poor Crypto Narrative’: In the fast-paced world of crypto, narrative is key. The current system might not be telling the most compelling story to attract and retain participants.

- Limited Deterrence Against Governance Attacks: Security is paramount in DeFi. The current system may not provide a strong enough defense against potential attacks targeting governance or vote manipulation.

📢 Governance Alert 📢

A new Governance Poll has been posted to ratify the Fast Track Spell for the Core Unit Budget Allocations for April – June 2022.

➡️ Cast your vote here: https://t.co/k4YWhb8m06

Poll ends March 17 at 16:00 UTC. #DeFi #DAI #Governance #MakerDAO pic.twitter.com/T8vOzV6XkF

— Maker (@MakerDAO) March 14, 2022

Enter stkMKR: The Proposed Solution

So, how does stkMKR aim to address these challenges? The proposal introduces stkMKR as the new primary governance token for MakerDAO. Think of it as an upgraded version of MKR, designed specifically for governance participation. Here’s the breakdown:

- Staking and Bonding Token: stkMKR would function as a staking or bonding token. MKR holders would deposit their tokens to receive stkMKR, essentially committing their tokens to governance.

- Enhanced Rewards System: ‘Monet-supply’ suggests a revamped rewards process with stronger incentives for staking. This could mean more attractive returns for those actively participating in governance.

MakerDAO & DAI: A Quick Refresher

For those new to the MakerDAO ecosystem, here’s a quick overview:

MakerDAO is a decentralized platform that allows users to generate DAI, a decentralized stablecoin pegged to the US dollar. Users deposit crypto assets like ETH or Bitcoin as collateral to mint DAI. This DAI can then be used in various DeFi activities, such as lending, borrowing, or providing liquidity.

When users want to reclaim their collateral, they repay the DAI ‘loan’, and the DAI is burned, reducing the circulating supply. This mechanism helps maintain DAI’s peg to the dollar.

Surplus utilization mechanism. Source: forum.makerdao.com

MKR Price Check

As of writing, MKR is trading around $1,766, holding steady for the day according to CoinGecko. However, it’s worth noting that MKR has experienced a decline of 11% in the past two weeks and is significantly down – 72% – from its all-time high of $6,292 in May 2021. This price context adds another layer to the potential significance of the stkMKR proposal.

What Does This Mean for You?

If you’re an MKR holder, this proposal could directly impact you. The shift to stkMKR could mean new opportunities for staking and potentially higher rewards for active governance participation. It’s crucial to stay informed about the MIP process and participate in governance discussions to voice your opinion.

For the broader crypto community, this proposal highlights the continuous evolution of DeFi protocols. MakerDAO’s willingness to consider such a significant tokenomics change demonstrates a commitment to improvement and long-term sustainability. It’s a reminder that even established projects are constantly innovating to optimize their systems.

Key Takeaways:

- MakerDAO is considering replacing MKR with stkMKR for governance.

- The proposal aims to address inefficiencies in the current ‘buyback and burn’ system.

- stkMKR would function as a staking token with enhanced rewards.

- This is still a proposal and requires a full governance vote to be implemented.

Actionable Insights:

- Stay Updated: Follow the MakerDAO forum and official channels for updates on the MIP process and governance votes.

- Participate in Discussions: If you’re an MKR holder, engage in community discussions about the stkMKR proposal.

- DYOR (Do Your Own Research): Understand the potential implications of stkMKR for MakerDAO and the DeFi ecosystem.

The potential transition from MKR to stkMKR is a significant development to watch in the DeFi space. It underscores the dynamic nature of crypto and the constant pursuit of better governance and tokenomics models. Will stkMKR become the new face of MakerDAO governance? Only time and the MakerDAO community will tell. Stay tuned for further updates as this proposal progresses!

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.