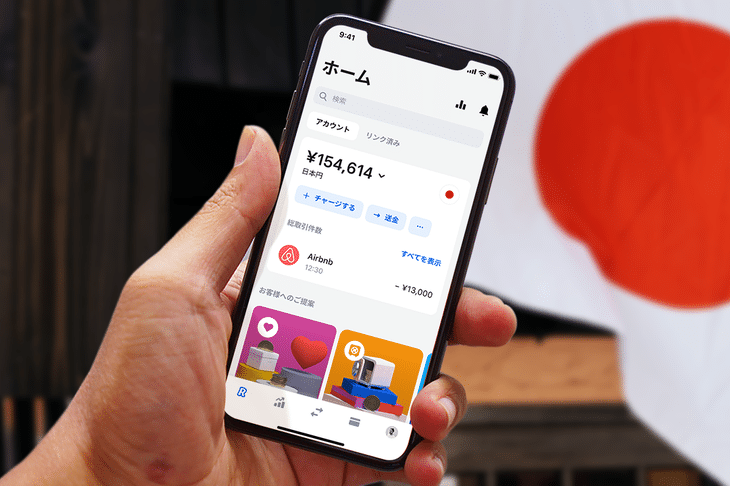

Exciting news for crypto enthusiasts and global finance aficionados! Revolut, the fintech giant known for its crypto-friendly approach and seamless international money transfers, has officially landed in Japan. After rigorous beta testing, the doors are now open for all Japanese residents to experience the Revolut revolution. Let’s dive into what this means for Japan’s evolving financial landscape and why it’s a significant move for both Revolut and its potential Japanese users.

Revolut Arrives in Japan: What’s the Buzz?

On September 8, 2020, Revolut announced via Twitter that its app is live in Japan. This marks a pivotal moment as Japan becomes Revolut’s first foray into a non-English speaking market. But why Japan? And what can Japanese users expect from this global fintech player?

First Steps in the Land of the Rising Sun

Smooth Rollout After Beta Testing

Before going live to the masses, Revolut meticulously tested its platform with 10,000 beta users in Japan. This ensured a polished and user-friendly experience right from the start. Now, anyone in Japan can download the app and start managing their finances with a modern, mobile-first approach.

Core Features: What’s Available Right Now?

Initially, Revolut is rolling out with a focused set of features in Japan. Think of it as the foundation upon which they’ll build their full suite of services. Here’s what Japanese users can access immediately:

- International Transfers: Need to send money abroad? Revolut offers low-fee international transfers, making it easier and cheaper to send Yen to friends and family overseas.

- Multi-Currency Management: Traveling or dealing with international transactions? Manage your funds in a whopping 23 different currencies directly from your smartphone. No more juggling multiple accounts or getting stung by hidden exchange rate fees!

Why Japan? Decoding Revolut’s Strategic Move

1. Expanding Horizons: A Global Growth Strategy

Japan is not just another market for Revolut; it’s a strategic cornerstone in their global expansion plan. Venturing into its first non-English speaking territory demonstrates Revolut’s ambition to become a truly global financial platform. With over 13 million users already, primarily in Europe and North America, Japan offers a significant opportunity to diversify and expand their user base.

2. Who is Revolut Targeting in Japan?

Revolut is setting its sights on two key demographics in Japan:

- Expatriates: Japan is home to a large and vibrant expat community. Revolut’s international transfer and multi-currency features are perfectly tailored to meet their needs for managing finances across borders.

- Tech-Savvy Japanese Residents: Beyond expats, Revolut aims to attract Japanese residents looking for a superior, digitally-driven banking experience. Think loyalty programs, user-friendly interfaces, and innovative financial tools.

3. Navigating the Pandemic Landscape

While the global pandemic has significantly impacted tourism and business travel – traditionally key use cases for services like Revolut – the company is taking a long-term view. They are positioning themselves as an essential financial tool for both expats *and* local Japanese users, recognizing the shift towards digital finance and the increasing need for efficient international money management, even beyond travel.

Revolut: From London Startup to Global Fintech Leader

A Quick Look at Revolut’s Journey

Founded in London in 2015, Revolut rapidly gained popularity by challenging traditional banking norms. Their recipe for success includes:

- Cost-Effective Banking: Offering services at significantly lower costs compared to traditional banks.

- Intuitive Mobile App: A sleek, user-friendly mobile app that puts financial control at your fingertips.

- Embracing Crypto: Early adoption and support for cryptocurrencies like Bitcoin and Ethereum, appealing to a new generation of investors.

Global Footprint

With a strong presence in Europe and North America, boasting over 13 million users, Revolut’s move into Japan underscores its ambition to become a dominant force in the global fintech arena. They are not just aiming for regional success; they’re building a worldwide financial network.

The Competition: Who Else is Playing in Japan’s Fintech Space?

Navigating a Crowded Market

Japan already has a dynamic fintech scene. Revolut will be competing with established players such as:

- LINE Pay: A popular mobile payment service integrated within the widely-used LINE messaging app.

- PayPay: Another dominant mobile payment platform in Japan, backed by SoftBank and Yahoo! Japan.

- Traditional Banks: Japanese banks are also evolving, offering their own localized mobile banking apps and digital services.

Revolut’s Unique Selling Points

So, how will Revolut stand out in this competitive landscape? Their key advantages include:

- Unbeatable International Transfer Rates: Offering highly competitive exchange rates and lower fees for international money transfers, a crucial advantage for expats and anyone dealing with cross-border payments.

- Seamless Multi-Currency Wallet: Managing 23 currencies in one app is a game-changer for international individuals and businesses.

- Crypto-Forward Approach: Revolut’s crypto-friendly platform is a significant draw for tech-savvy users and those interested in digital assets, particularly in a market like Japan with a strong interest in cryptocurrencies.

Looking Ahead: What’s Next for Revolut in Japan?

Revolut’s initial launch is just the beginning. They have ambitious plans to expand their offerings in Japan, including:

- Loyalty and Rewards: Introducing loyalty programs to incentivize daily use and build a strong user base among Japanese consumers.

- Advanced Financial Products: Rolling out premium banking features such as insurance products, savings accounts, and investment tools to cater to a wider range of financial needs.

- Cryptocurrency Trading: Bringing crypto trading capabilities to the Japanese market, tapping into the country’s growing appetite for digital assets and potentially differentiating themselves from competitors.

Benefits for Japanese Consumers: Why Should You Care?

Revolut’s arrival in Japan translates to tangible benefits for Japanese consumers:

- Cost Savings: Significantly cheaper international money transfers compared to traditional banks, saving users money on cross-border transactions.

- Convenience and Simplicity: A user-friendly mobile app that simplifies multi-currency management and everyday financial tasks, all in one place.

- Access to Innovation: Future access to loyalty rewards, advanced financial products, and potentially cryptocurrency trading, bringing cutting-edge fintech services to Japan.

Frequently Asked Questions (FAQs)

1. What services are currently available in Japan?

Right now, Revolut offers international money transfers and multi-currency account management in 23 currencies.

2. Can I buy and sell cryptocurrencies with Revolut in Japan?

Not yet. Cryptocurrency trading is planned for the future as part of Revolut’s expanded services in Japan.

3. Who is Revolut targeting in the Japanese market?

Revolut is focusing on both expatriates living in Japan and local Japanese residents seeking a modern, efficient banking alternative.

4. Why is Japan a strategic market for Revolut?

Japan is Revolut’s first non-English speaking market and a key part of its global expansion strategy, offering access to a large and tech-savvy population.

5. How many users does Revolut have globally?

Revolut boasts over 13 million users worldwide, primarily in Europe and North America.

The Bottom Line: Revolut’s Japanese Chapter Begins

Revolut’s launch in Japan is more than just another market entry; it’s a statement of intent. By offering core financial services like multi-currency accounts and affordable international transfers, Revolut is poised to attract both expats and local Japanese users seeking a better way to manage their money.

With future plans to introduce cryptocurrency trading and other advanced features, Revolut has the potential to significantly disrupt Japan’s fintech landscape and solidify its position as a global leader in digital finance. Keep an eye on this space – the Revolut revolution in Japan is just getting started!

Want to stay updated on the latest innovations in the crypto world? Explore our article on latest news to discover more groundbreaking ventures and trends shaping the future of finance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.