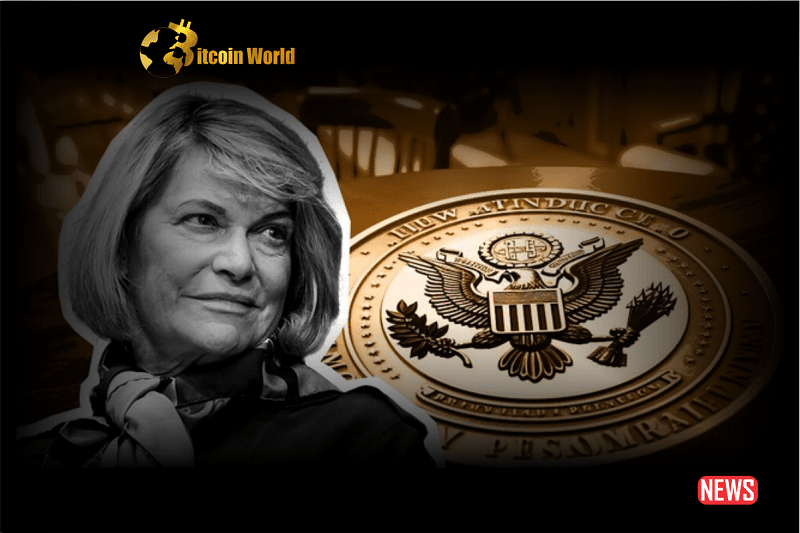

The high-stakes legal showdown between crypto exchange giant Coinbase and the U.S. Securities and Exchange Commission (SEC) just got a significant boost for Coinbase. Imagine a seasoned political player stepping onto the field, not to directly play the game, but to offer crucial strategic advice and support. That’s precisely what United States Senator Cynthia Lummis, a well-known advocate for the crypto industry, has done by filing an amicus brief in support of Coinbase’s motion to dismiss the SEC’s lawsuit.

Why is Senator Lummis’s Amicus Brief a Big Deal?

While not a direct party to the lawsuit, an amicus brief (Latin for “friend of the court”) allows individuals or organizations with a strong interest in the case to offer their expertise and perspective. Senator Lummis’s involvement isn’t just a casual observation; it carries considerable weight for several reasons:

- Amplified Voice for Coinbase: Her brief reinforces Coinbase’s arguments, adding a layer of political and legislative insight to the legal proceedings.

- Broader Implications Highlighted: It underscores that this case isn’t just about Coinbase; it has far-reaching consequences for the entire cryptocurrency industry and the regulatory landscape.

- Congressional Perspective: Senator Lummis brings a crucial perspective from Capitol Hill, emphasizing the role of Congress in defining crypto regulation.

What Are the Core Arguments in the Amicus Brief?

Filed on August 11th with the U.S. District Court for the Southern District of New York, Senator Lummis’s brief doesn’t mince words. She argues that the SEC’s lawsuit represents a power grab, an attempt to assert control over the burgeoning crypto sector without explicit congressional authorization. Let’s break down her key points:

- Beyond a Typical Enforcement Case: Senator Lummis believes the SEC is using this lawsuit to establish sweeping regulatory authority over crypto, a move she deems inappropriate.

- Timing is Everything: She emphasizes that this action comes at a time when Congress and global bodies are actively debating crypto regulation, making the SEC’s unilateral move even more significant.

- Congress’s Prerogative: A central argument is that the power to legislate on matters of such economic and political importance rests with Congress, not the SEC.

- Challenging the SEC’s Authority: Senator Lummis questions the SEC’s move to claim such broad authority, especially with ongoing legislative efforts aimed at assigning regulatory powers to various agencies.

Coinbase’s Defense and Lummis’s Support: A United Front

Coinbase’s motion to dismiss, filed a week prior on August 4th, accuses the SEC of overstepping its boundaries and contradicting its previous interpretations of securities laws. Senator Lummis’s amicus brief directly supports these claims. She specifically challenges the SEC’s attempt to shoehorn diverse crypto assets into the existing definition of a ‘security.’

Think of it like trying to fit a square peg into a round hole. Senator Lummis argues that the SEC is attempting to apply outdated definitions to a fundamentally new asset class. She highlights the inherent contradiction in the SEC’s approach, accusing the agency of essentially making law through enforcement actions rather than following established legislative processes.

The Chorus of Support: Crypto Advocacy Groups Join the Fray

Senator Lummis isn’t a lone voice in the wilderness. On the same day her brief was filed, a powerful coalition of crypto advocacy groups also submitted their amicus brief. This coalition includes influential organizations like the Blockchain Association, Crypto Council for Innovation, Chamber of Progress, and Consumer Tech Association. This unified front underscores the widespread concern within the industry regarding the SEC’s approach.

Marisa Tashman, Senior Counsel at the Blockchain Association, echoed Senator Lummis’s concerns, emphasizing the potential for the SEC’s broad interpretation to inadvertently cover assets that were never intended to be classified as securities. This could stifle innovation and create unnecessary regulatory hurdles for the crypto industry.

What Does This Mean for the Future of Crypto Regulation?

Senator Lummis’s involvement, alongside the collective action of crypto advocacy groups, significantly elevates the stakes in the Coinbase vs. SEC lawsuit. It transforms a company-specific legal battle into a broader debate about regulatory authority and the future of cryptocurrency in the United States. Here’s a look at the potential implications:

| Aspect | Potential Impact |

|---|---|

| Legal Precedent | The outcome of this case could set a significant precedent for how crypto assets are regulated in the US. |

| Congressional Influence | Senator Lummis’s involvement highlights the ongoing tension between regulatory agencies and Congress regarding crypto oversight. |

| Industry Growth | A ruling in favor of Coinbase could provide more clarity and potentially foster innovation within the crypto space. |

| SEC’s Approach | A loss for the SEC could force the agency to reconsider its current enforcement-focused approach to crypto regulation. |

Key Takeaways: Why You Should Pay Attention

- High-Stakes Legal Battle: The Coinbase vs. SEC lawsuit is a landmark case with significant implications for the crypto industry.

- Senator Lummis’s Support: Her amicus brief adds considerable weight to Coinbase’s defense, highlighting the potential overreach of regulatory authority.

- Industry-Wide Concern: The involvement of major crypto advocacy groups underscores the collective apprehension regarding the SEC’s stance.

- Broader Regulatory Debate: This case is part of a larger discussion about how cryptocurrencies should be regulated in the US and the appropriate roles of different government bodies.

In Conclusion: A Battle with Far-Reaching Consequences

Senator Lummis’s decision to file an amicus brief in support of Coinbase marks a pivotal moment in the ongoing saga between the crypto industry and regulatory bodies. It injects a crucial Congressional perspective into the legal discourse, emphasizing the need for clear and appropriate regulatory frameworks. As this case unfolds, its outcome will undoubtedly shape the future of cryptocurrency innovation and regulation in the United States, making it a crucial development for anyone involved in or interested in the digital asset space.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.