Hold onto your hats, SHIB army! The popular meme coin, Shiba Inu (SHIB), has experienced a notable dip in price. If you’re tracking your SHIB holdings, you might have noticed some red in your portfolio recently. Let’s break down what’s happening with SHIB’s price and what factors are at play.

Shiba Inu Price in the Red: What’s Driving the Downtrend?

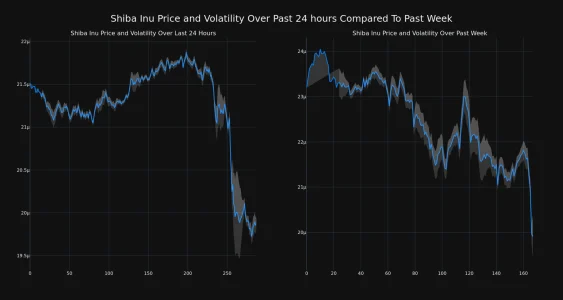

Over the past 24 hours, the price of Shiba Inu (SHIB) has decreased by 7.73%, currently sitting at $0.000020. This isn’t just a short-term blip; it’s a continuation of a downward trend observed over the last week. Looking back at the past seven days, SHIB has seen a significant 14.0% decrease, falling from $0.000023 to its current level. This consistent decline raises some important questions for investors and enthusiasts alike. Is this a temporary pullback, or is there more to this downward pressure?

To visualize this price action, take a look at the charts below. They compare SHIB’s price movement and volatility over the last 24 hours (left) and the past week (right).

The gray bands you see in these charts are Bollinger Bands. Think of them as volatility indicators. They help us understand how much the price of SHIB is fluctuating. Essentially, the wider these bands are, the more volatile SHIB’s price has been. A larger gray area indicates higher price swings in both directions.

Decoding Volatility: What Do Bollinger Bands Tell Us About SHIB?

Bollinger Bands are a powerful tool for traders and investors. Here’s a simple breakdown of what they signify in the context of SHIB’s recent price action:

- Width of the Bands: As mentioned, wider bands suggest higher volatility. If the bands are narrow, it indicates lower volatility, meaning the price is relatively stable.

- Squeezing Bands: Sometimes, you might see the Bollinger Bands narrow significantly. This ‘squeeze’ can often precede a period of increased volatility and a potential price breakout (either upwards or downwards).

- Price Interaction with Bands: Generally, when the price touches the upper band, it might be considered overbought, potentially signaling a price correction. Conversely, if the price touches the lower band, it could be seen as oversold, suggesting a potential price rebound.

Looking at the charts, analyzing the width of the Bollinger Bands can provide insights into the level of risk and potential trading opportunities associated with Shiba Inu at different timeframes.

Trading Volume Dries Up While Supply Increases: A Double Whammy?

Adding another layer to the SHIB price story, the trading volume for the coin has decreased by a significant 34.0% over the past week. In simpler terms, fewer people are actively buying and selling SHIB compared to the previous week. This decline in trading activity can often contribute to price drops, as there’s less buying pressure to support the price.

Interestingly, this decrease in trading volume is happening alongside an increase in the circulating supply of SHIB. The circulating supply has edged up by 0.63% recently. This means there are slightly more SHIB tokens available in the market. When supply increases and demand (reflected in trading volume) decreases, basic economics tells us that price tends to fall. It’s a classic supply-demand dynamic at play.

Currently, the circulating supply of SHIB stands at a massive 589.26 trillion tokens. Despite the recent price decline, Shiba Inu still holds a respectable position in the cryptocurrency market. According to our data, SHIB is currently ranked #12 in terms of market capitalization, boasting a market cap of $11.70 billion. This ranking highlights the significant value still associated with Shiba Inu within the crypto space.

Key Takeaways: What Does This Mean for SHIB Investors?

Let’s summarize the key points and consider what they might mean for those holding or considering investing in Shiba Inu:

- Price Downtrend: SHIB is currently experiencing a clear downward price trend, both in the short-term (24 hours) and medium-term (7 days).

- Increased Volatility: The Bollinger Bands suggest ongoing price volatility, meaning price swings can be expected.

- Decreased Trading Volume: Lower trading volume can exacerbate price declines as there is less buying interest.

- Increased Circulating Supply: A slight increase in circulating supply, combined with decreased demand, puts downward pressure on price.

- Market Cap Still Significant: Despite the price drop, SHIB remains a top cryptocurrency by market capitalization, indicating continued community support and overall value.

Navigating the SHIB Waters: What Should You Do?

The cryptocurrency market is known for its volatility, and meme coins like Shiba Inu can experience even more dramatic price swings than established cryptocurrencies. Understanding the factors influencing SHIB’s price, like trading volume, circulating supply, and overall market sentiment, is crucial for making informed decisions.

Important Disclaimer: Before making any investment decisions, remember that the information provided here is for analysis and informational purposes only and should not be considered financial or trading advice. The cryptocurrency market is inherently risky. Always conduct thorough independent research and consider consulting with a qualified financial advisor before investing in cryptocurrencies like Shiba Inu or any other digital asset. Your investment decisions should be based on your own risk tolerance and financial situation.

In Conclusion: Shiba Inu is currently navigating a period of price decline and increased volatility. While the long-term trajectory of SHIB, like all cryptocurrencies, is uncertain, understanding the current market dynamics can help you stay informed and make more calculated choices in the ever-evolving crypto landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.