- Bitcoin (BTC) has continued its downward movement over the past week, dropping below the $40,000 mark for the first time in over two weeks as spot Bitcoin ETFs triggered a sell-off instead of a surge in demand.

Bitcoin (BTC) has continued its downward trajectory over the past week, dropping below the $40,000 mark for the first time in over two weeks.

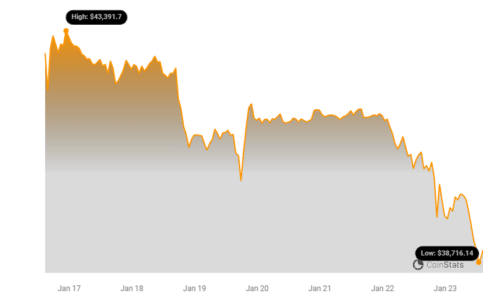

According to Coinstats, Bitcoin (BTC) is currently trading at $38,967.62, having shed nearly 7% of its value in the past 24 hours, and 8% over last week.

The latest price dip comes just days after the much-anticipated approval of spot Bitcoin exchange-traded funds (ETFs) in the United States.

These investment vehicles, which allow investors to gain exposure to Bitcoin without directly purchasing the cryptocurrency, were seen as a major milestone for the digital asset industry.

However, instead of triggering a surge in demand, the launch of Bitcoin ETFs appears to have led to a sell-off.

See Also: Bitcoin Price Has Continued To Fall, Dropping Below $40,000

Analysts believe that investors are cashing out of ETFs, particularly Grayscale’s Bitcoin Trust, which recently converted to a spot BTC ETF.

The Grayscale Bitcoin Trust previously traded like a closed-end investment vehicle, making it difficult for investors to redeem their shares.

Following the conversion, investors have been quick to cash out, leading to a significant outflow of Bitcoin from the fund. This, in turn, has put downward pressure on the price of Bitcoin.

The broader cryptocurrency market is also feeling the heat, with altcoins like Ethereum (ETH) and Solana (SOL) both experiencing notable declines.

ETH is down more than 4.45% in the past 24 hours and is trading at $2,214, while SOL declined by 6.09% in a day, currently priced at $80.12.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.