At the start of the weekend, the world’s largest cryptocurrency, bitcoin continued to test lower levels, falling below $42,000. While it’s tough to forecast a bottom at this time. Then, there are several important indicators that can assist us in determining our next course of action.

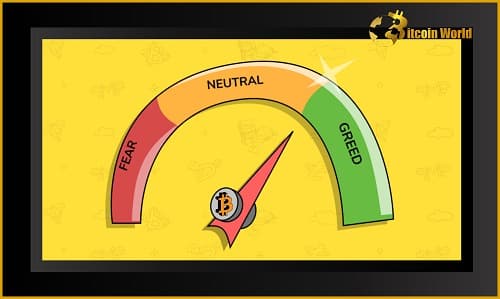

The Bitcoin Fear and Greed Index is at its lowest level since July 2021. This demonstrates that Bitcoin investors are extremely fearful. Then, its on historical tendencies, it may be a good opportunity for Bitcoin dip buyers.

“The Crypto Fear and Greed Index falls to 10, the lowest since July 21, 2021.”

pic.twitter.com/ZNbTnuH3cb — Wu Blockchain (@WuBlockchain) January 8, 2022

Then, Benjamin Cowen, another popular crypto market analyst from CryptoQuant, says

“We do not usually go this low on fear and greed (for Bitcoin).”

“If we bounce here, I’m not convinced we won’t revisit these prices,”

“but some short-term relief would be nice. Daily RSI is also technically oversold,”

” $40k-$42k is theoretically a support area too”.

Mike Novogratz, a Wall Street veteran and the head of Galaxy Digital. Of course, recently tells CNBC that Bitcoin might find a bottom at either $40,000 or $38,000. Institutional players, according to Novogratz. Of course, are waiting for an entry at this level since new cash is to flood in soon.

Related Posts – Ex-SEC Chair, Jay Clayton Believes Cryptocurrency Industry Is For Long Haul