The Cryptocurrency market’s bad luck in 2022 resumed this morning. Of course, with Bitcoin leading a nearly 10% market decline as worries about military tensions between Russia and Ukraine resurfaced.

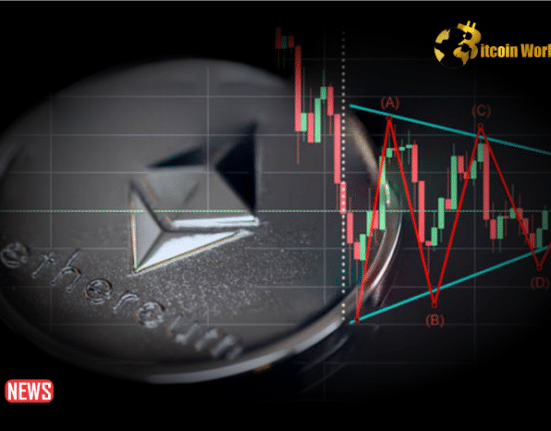

According to CoinMarketCap, the world’s largest cryptocurrency fell over 8% to US$40,643 during business hours Friday Asia time. Also, Ethereum experiences much worse, trading at US$2,889 at press time.

Markets have been shaken by rising military tensions between Russia and Ukraine. That’s, as the US warns that Russia may stage a false flag operation as a pretext for invasion after pretending to withdraw from the fight earlier this week.

Terra, the darling of decentralized finance (DeFi), was one among the biggest losers. Thereby, falling as much as 12% in 24 hours before recovering slightly to trade at US$51.06 at press time.

“Tensions between Russia and Ukraine seem to have spooked clients”

” and caused stress for some investors to sell risky assets,” As a result, according to George Liu, head of derivatives trading at crypto-financial firm Babel Finance. That’s, saying investors have shifted their portfolios away from risky assets in the market and toward safer assets such as bonds.

“[Babel is] closely monitoring the market as the geopolitical tensions could be the”

” key swinging factor on market confidence in the coming weeks.”

Concerns about interest rate hikes in the United States have had a chilling effect on crypto. Then, and traditional markets as investors await the outcome of the Federal Reserve’s March meeting. Whereby, the magnitude of rate hikes will be debated.

As the competition for capital heats up, a rise in interest rates often leads to investors acting more cautiously.

These reasons have had a continuous influence on crypto this year, as it has battled to keep its market capitalization above $2 trillion. Its current value of US$1.8 trillion is around 40% lower than its all-time high set in November.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…