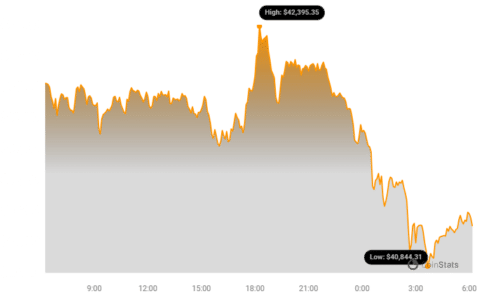

Bitcoin (BTC) faced a tumultuous day in the cryptocurrency market, with its ticker symbol, BTC, declining in price sharply to $42,882.

This drop of over $1,300, equivalent to 3.2%, occurred on the heels of a brief recovery from recent volatility. Bitcoin struggled to maintain its position above $43,000 as the bulls failed to gain momentum.

The decline in BTC’s price coincided with news that the United States Securities and Exchange Commission (SEC) had rejected a request from major cryptocurrency exchange Coinbase to revise the rules governing crypto.

SEC Chair Gary Gensler expressed his support for the Commission’s decision, emphasizing that existing laws and regulations apply to the cryptocurrency securities market.

He also stressed the importance of maintaining the Commission’s discretion in setting its own rulemaking priorities.

The SEC’s involvement in the crypto market has been closely watched, especially with expectations that it will approve the first U.S. Bitcoin spot price exchange-traded funds (ETFs) in early 2024.

Gensler clarified that the SEC’s actions are based on its authorities and how courts interpret those authorities.

Analyzing the order books, traders noticed an increase in bid support around the $41,000 level, which became a point of interest.

There was also active supply noted around the $44,000 mark, suggesting a key resistance zone.

On the technical side, the four-hour exponential moving averages (EMAs) were once again in play, with the price contesting these levels and the relative strength index (RSI) dipping below 50.

This setup indicated an impending crucial close in the price action.

See Also: Top Cryptocurrencies To Watch This Week: XRP, ADA, SHIB

Zooming out to a broader perspective, Keith Alan, co-founder of trading resource Material Indicators, observed an ongoing struggle to turn a significant weekly level into support.

This challenge centered around the 0.5 Fibonacci retracement line near $42,500, which represented one of the critical hurdles on the path to revisiting the all-time high of $69,000.

Material Indicators also reported that large-volume traders were showing increased buying activity at the time, suggesting that “Mega Whales” were trying to reclaim the $42,000 price level.

This battle between buyers and sellers indicated the potential for further price volatility in the Bitcoin market.

In summary, Bitcoin faced a downward correction below $43,000, influenced by the SEC’s decision regarding Coinbase’s rule request.

The cryptocurrency market remained dynamic, with traders closely monitoring key support and resistance levels, as well as the actions of significant market players.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.