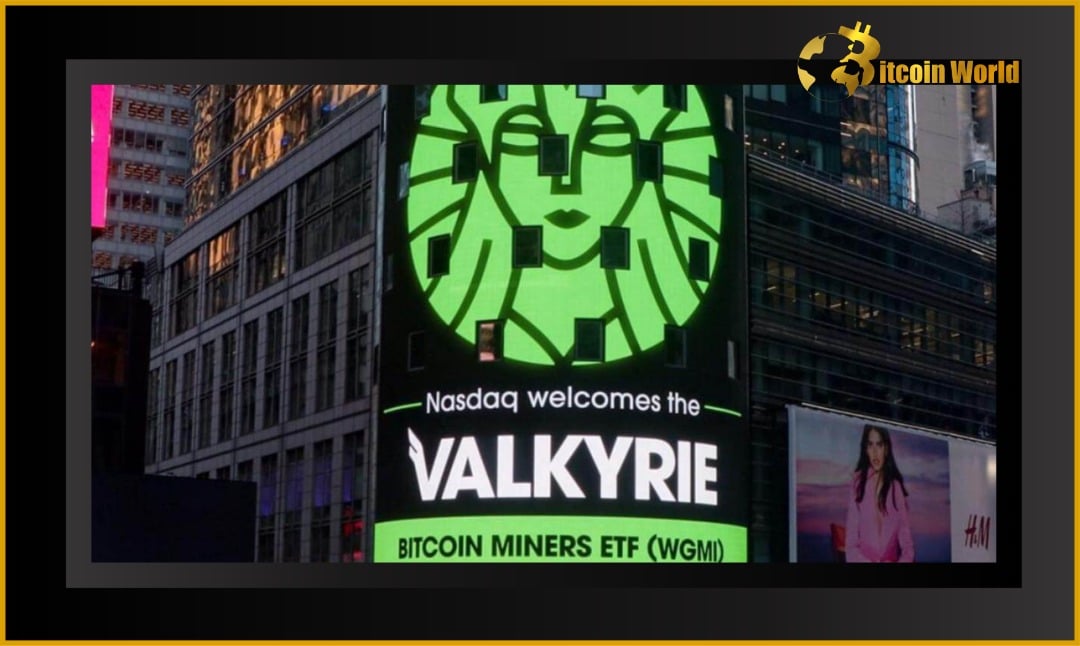

Exciting news for crypto enthusiasts and investors! Valkyrie’s Bitcoin Miners ETF is set to debut on the Nasdaq, trading under the ticker WGMI. Yes, you read that right – another Bitcoin-related ETF is hitting the market, but this one has a unique twist. Let’s dive into what this means and why it’s making waves in the crypto world.

What’s the Buzz About Valkyrie’s Bitcoin Miners ETF?

In a recent filing with the US Securities and Exchange Commission (SEC), it was revealed that Nasdaq has given the nod to Valkyrie’s Bitcoin Miners ETF. This ETF isn’t your typical Bitcoin investment vehicle; it’s designed to focus on companies deeply involved in Bitcoin mining. Think of it as a way to invest in the infrastructure that powers the Bitcoin network itself.

Valkyrie wasted no time in getting this application in front of the SEC, submitting it less than a month prior to the approval. This swift turnaround signals a growing momentum and perhaps increasing regulatory comfort, at least with certain types of crypto-related investment products.

Decoding the ETF: What Will WGMI Invest In?

So, what exactly will the Valkyrie Bitcoin Miners ETF hold? According to the filing, at least 80% of its assets will be directed towards companies that:

- Generate at least 50% of their revenue or profits from Bitcoin mining operations.

- Provide specialized chips, hardware, software, or services to Bitcoin mining companies.

This targeted approach allows investors to tap into the Bitcoin ecosystem beyond just holding the cryptocurrency itself. It’s a play on the growth of the mining industry, which is crucial for the security and operation of the Bitcoin network.

A Green Focus: Renewable Energy in Bitcoin Mining

Interestingly, Valkyrie has stated that the ETF will prioritize crypto mining companies that utilize green and renewable energy sources. This is a significant point, addressing a common concern about Bitcoin’s environmental impact. By focusing on miners with sustainable practices, Valkyrie is aligning with the growing global push for environmentally responsible investments.

Mark your calendars! The Valkyrie Bitcoin Miners ETF, trading under “WGMI,” is scheduled to begin trading on Nasdaq starting February 8, 2022. This launch adds another layer of accessibility for investors interested in the crypto space through traditional markets.

Valkyrie’s Track Record: Not Their First Crypto ETF Rodeo

While the Bitcoin Miners ETF is generating excitement, it’s worth noting that this isn’t Valkyrie’s first foray into crypto ETFs. The SEC previously approved Valkyrie’s Bitcoin Futures ETF in October, making it the second of its kind in the US, following ProShares’ Bitcoin Futures ETF. This prior approval demonstrates Valkyrie’s established presence and credibility in navigating the regulatory landscape for crypto investment products.

The Spot Bitcoin ETF Standoff: SEC’s Hesitation Continues

Now, let’s address the elephant in the room – the elusive spot Bitcoin ETF. While Valkyrie’s Bitcoin Miners ETF and their Futures ETF have received the green light, the SEC remains cautious about approving a spot Bitcoin ETF, which would directly hold Bitcoin.

Recent events highlight this ongoing hesitation:

- SkyBridge’s Rejection: In January, the SEC rejected SkyBridge’s spot Bitcoin ETF application, citing unmet standards.

- Valkyrie and Kryptoin’s Previous Rejections: Valkyrie and Kryptoin have also faced rejections for their spot Bitcoin ETF bids in the past.

- Grayscale’s GBTC Conversion Postponement: The SEC recently postponed its decision on Grayscale’s application to convert its massive Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF. This decision is highly anticipated in the market, as GBTC is a significant player in crypto investment.

The SEC’s primary concerns revolve around investor protection, market manipulation, and the need for robust surveillance-sharing agreements with regulated exchanges. The agency wants to ensure that the Bitcoin market is mature and resistant to fraud before allowing spot Bitcoin ETFs to trade.

What Does This Mean for the Future of Bitcoin ETFs?

The approval of Valkyrie’s Bitcoin Miners ETF is a positive step forward for the crypto industry. It shows that the SEC is willing to engage with and approve innovative crypto-related investment products, even while remaining cautious about spot Bitcoin ETFs.

Here’s a quick summary of what we can take away:

- Diversification in Crypto ETFs: The market is seeing diversification beyond just Bitcoin futures ETFs, with products like Bitcoin Miners ETFs emerging.

- Regulatory Nuance: The SEC’s approach is nuanced, differentiating between different types of crypto exposure. They seem more comfortable with indirect exposure through futures or mining companies than direct spot exposure for now.

- Growing Acceptance (Slowly but Surely): Each ETF approval, even for niche products, contributes to the gradual acceptance and integration of crypto into mainstream finance.

- Spot Bitcoin ETF Still on the Horizon: The demand for a spot Bitcoin ETF is undeniable, and while the SEC is taking its time, the pressure and the potential benefits may eventually lead to a change in stance.

The launch of Valkyrie’s Bitcoin Miners ETF is an exciting development, offering a new avenue for investors to participate in the growth of the Bitcoin ecosystem. While the wait for a spot Bitcoin ETF continues, this approval signals that the crypto ETF landscape is evolving, and more innovative products are likely on the way. Stay tuned!

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.