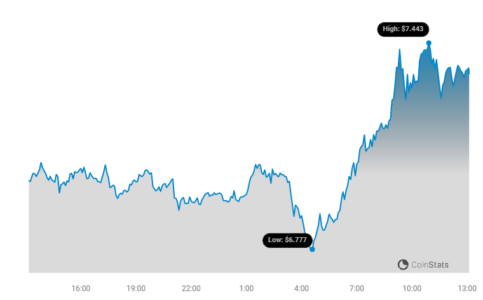

- Toncoin (TON) price is inches away from forming a new all-time high should it close above $7.67.

- The whales have been driving the rally, adding more than $2.5 million worth of TON this week.

- Given that the RSI is in the overbought zone, correction could follow as soon as the ATH is formed.

Toncoin’s (TON) price is notable for its considerable gains, placing it among some of the best-performing assets.

However, as close as TON is to noting an achievement, it is also close to observing a decline following the rise.

Toncoin Is Close to Making History

Toncoin’s price could likely form a new all-time high in the coming days as the altcoin is close to breaching the previous one.

Aiding this rally are the whale addresses that have been consistently accumulating for the last week.

In five days, addresses holding between 10,000 and 100,000 TON have added more than 350,000 TON. This $2.5 million supply is the largest bout of buying noticed in a week since mid-March.

See Also: Binance Launches USDC Flexible Products, Offering Users Up to 8% APR Rewards

This shows that the large wallet holders are eminently anticipating a new ATH. However, this also means they might move to sell once the ATH of $7.3 is breached. The consequent decline could pull the altcoin back down quickly.

The same sentiment is being observed in the broader market cues as well, observed from the Relative Strength Index (RSI). RSI, a momentum oscillator, measures the speed and change of price movements. It is used to identify overbought or oversold conditions in a market.

Based on this reading, TON is visibly in the overbought region, well above the threshold of 70.0. Historically, a breach into this zone is followed by correction as the market cools down.

Although, the bullishness still continues for a day or two before the correction is initiated.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN