Fresh Funds to Broaden Stablecoin Reach to Institutional Investors, Family Offices, Individual Investors, Exchanges, and Payment Processors.

Y Combinator, Arca Capital lead the round with the participation of the Hong Kong-based DP88 Capital and the Singaporean Artichoke Capital.

Brazil, Sao Paulo (Mar 19th, 2023) – ECSA, a stablecoin issuer based in Brazil, has successfully secured $3M USD during a pre-seed funding round, drawing prominent investors such as Y

Combinator and the crypto-focused funds Arca Capital, Artichoke Capital, and DP88 Capital.

The firm plans to utilize the capital to widen the reach of its stablecoins to exchanges, payment processors, institutional investors, and family offices.

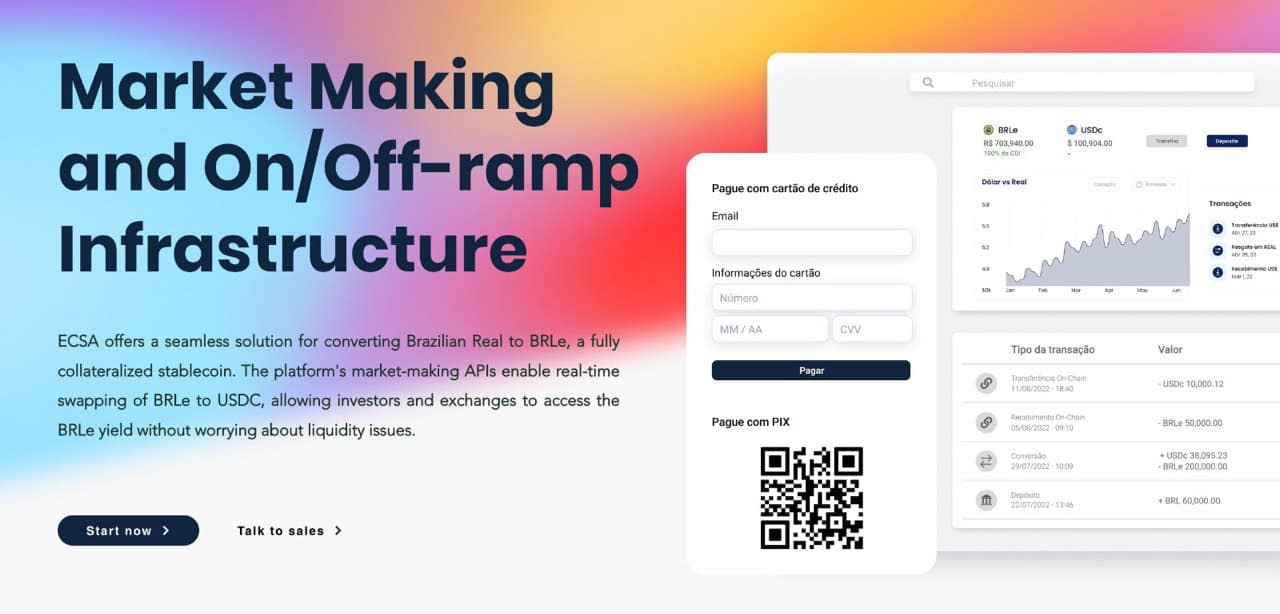

Stablecoins provide the most efficient method for crypto exchanges to execute On and Off-ramp transactions, as they enable instant settlements, thereby reducing the need for the Exchange to tie up working capital in order to provide clients with immediate access to funds for trading or investing. In contrast, traditional alternatives, such as conducting Swift transfers, take over two days to complete and incur substantial associated costs.

“Our goal is to serve as the gateway for international exchanges looking to enter the Brazilian market, simplifying the process of acquiring clients and allowing them to concentrate on their Go to Market strategies, while relying on us as an On and Off-ramp partner” – stated Joao Aguiar,

ECSA’s co-founder.

“By offering access to our PIX Gateway, we enable these foreign exchanges to cater to the needs of their clients through the most popular payment method in Brazil, PIX, utilized by 142 million individuals across the country. This approach enables seamless integration into the local market and ensures a smooth customer experience.”

Central to ECSA‘s approach is its Brazilian Real stablecoin, BRLe. BRLe is fully collateralized by Brazilian Treasury Bills and safeguarded by some of Latin America’s largest banks. The collateral is in the process to start to be audited by Grant Thornton.

“Currently, BRLe is issued on the Stellar network and is in the process of being issued on

Ethereum ERC-20,” noted Rodrigo Marino, ECSA’s co-founder. “ECSA is committed to offering a market-making solution that ensures liquidity for BRLe, facilitating seamless exchange with other tokens like USDc and USDt.”

ECSA’s legal advisors for the transaction were Novotny and VBSO Advogados.

The co-founders of ECSA, João Aguiar, and Rodrigo Marino, met at the university and bring a wealth of experience to the company.

Joao has a background in hedge funds and trading companies like Leste Global Investments and Comexport, while Rodrigo has experience in Offshore Structured Products and Venture Capital in companies like Itau-BBA and Indicator Capital.

Prior to founding ECSA, the pair were partners at DIF Markets, a stock brokerage firm in Latin America, which was sold to a Brazilian Fintech and a consortium of funds in 2021.