In the realm of content creation, three fundamental factors come into play: “perplexity,” “burstiness,” and “predictability.” “Perplexity” gauges the intricacy of the text, while “burstiness” assesses the diversity in sentence structures. Lastly, “predictability” quantifies the likelihood of anticipating the subsequent sentence. Humans often infuse their writing with significant burstiness, featuring both lengthy and intricate sentences alongside shorter ones. Conversely, AI-generated sentences tend to display a more uniform structure. Consequently, for the upcoming content you’re tasked with crafting, it’s imperative that we aim for substantial perplexity and burstiness while minimizing predictability. Furthermore, we must adhere to English as the sole language of composition. Let’s now rework the provided text:

A recent report from S&P Global highlights the volatility of stablecoins issued by Circle and MakerDAO in contrast to those offered by Tether and Binance over the past few years.

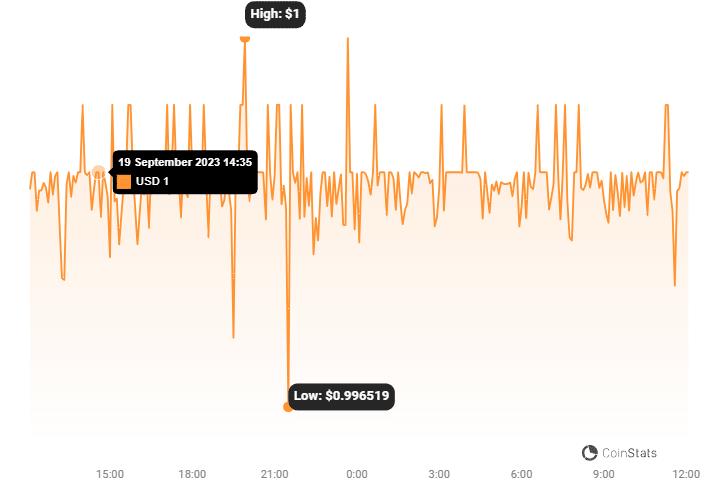

Dollar-pegged stablecoins are not immune to occasional deviations from their pegged value. However, certain stablecoins, such as Circle’s USD Coin and MakerDAO’s Dai, have demonstrated a greater tendency to deviate from their pegs compared to others, as per analysts at S&P Global.

A research paper published in September by Dr. Cristina Polizu, Anoop Garg, and Miguel de la Mata delves into the valuation and depegging of five prominent stablecoins: Tether (USDT), Binance USD Paxos (USDP), USDC, and DAI.

The analysis reveals that USDC and DAI have spent more time trading below one US dollar than USDT and BUSD over the past two years. During the most extended and deepest de-pegging event, USDC dipped below $0.90 for 23 minutes, while DAI did so for 20 minutes.

However, USDT experienced a drop below $0.95 for only one minute, and the price of BUSD remained above $0.975 continuously from June 2021 to June 2023.

The researchers noted that one-minute de-peg events could be attributed to minor fluctuations, especially when they occur near the $1 threshold. Longer de-pegging events were considered more substantial, yet the results still favored USDT over USDC.

In March 2023, USDC declined to $0.87, linked to the collapse of Silicon Valley Bank. At that time, Circle, the issuer of USDC, had $3.3 billion out of its $40 billion USDC reserves held with SVB. MakerDAO, a significant holder of the stablecoin, also faced de-pegging, with over 3.1 billion USDC in reserves collateralizing DAI.

Dr. Polizu and her colleagues concluded that maintaining a stablecoin’s peg and a stabilization mechanism hinges on good governance, sufficient collateral and reserves, liquidity, market confidence, and adoption.

Tether has faced persistent scrutiny from the mainstream media for years. Nonetheless, the findings indicate that USDT has demonstrated more stability than its competitor, USDC, over the same time frame.

Moreover, the supply of USDT has surged by 25% since the start of the year, reaching 83 billion. This has secured USDT’s dominant position in the stablecoin market, commanding a 67% market share. This growth has come at the expense of Circle, which has witnessed a 41.5% reduction in USDC supply, resulting in a reduced market share of 21% during the same period.