Hold onto your hats, crypto enthusiasts! The Ethereum waters are getting interesting as a massive whale has just made a significant move. LookOnChain, the ever-watchful blockchain analytics platform, has spotted an Ethereum whale making waves by withdrawing a staggering 8,398 ETH, worth approximately $15.9 million, from the leading crypto exchange, Binance. Let’s dive into what this means and why it’s got the crypto community buzzing.

Whale Alert: Millions in ETH Moves Off Binance

Imagine seeing a transaction alert pop up showing millions of dollars worth of Ethereum leaving a major exchange. That’s precisely what happened, and here’s the scoop:

- Blockchain sleuths at LookOnChain revealed that an Ethereum whale with the address “0xb15” initiated a substantial withdrawal.

- The whale pulled out 8,398 ETH, which at current prices translates to a cool $15.9 million.

- This isn’t the first rodeo for this particular whale; they’ve been actively depositing and withdrawing large sums of ETH to and from Binance recently.

- Interestingly, this whale has a track record of profitable trades, having already pocketed over $14.7 million in profits from previous ETH maneuvers.

This activity has definitely caught the attention of traders and analysts alike. Why would a whale move such a significant amount of ETH off an exchange? Let’s explore the potential reasons.

Is This Whale Betting Big on Ethereum?

Whale movements are often seen as indicators of market sentiment, and this withdrawal could be interpreted in a few ways. One popular theory is that moving crypto off exchanges suggests a bullish outlook. Why? Because:

- Long-Term Holding: Withdrawing ETH to a private wallet could indicate a desire to hold the assets for the long term, rather than for active trading on an exchange. This suggests confidence in Ethereum’s future price appreciation.

- DeFi and Staking: Whales might move their ETH to participate in Decentralized Finance (DeFi) protocols or staking opportunities outside of centralized exchanges to earn yield.

- OTC Deals: Large withdrawals could also be related to Over-the-Counter (OTC) deals, where whales buy or sell large amounts of crypto directly, bypassing exchanges.

Considering this whale’s history of ‘buying low and selling high,’ as highlighted by Lookonchain, this withdrawal could very well be a strategic move anticipating further price increases for Ethereum.

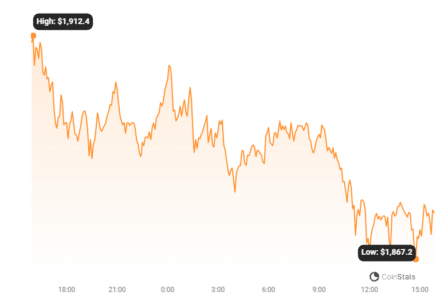

Ethereum Price Showing Signs of Life

Adding fuel to the speculative fire, Ethereum’s price has shown positive momentum recently. Over the last 24 hours, Ether (ETH) has experienced a marginal gain of 0.55%, and looking at the bigger picture, it’s up by 5.37% over the past week according to CoinMarketCap data. This price uptick comes as Ethereum edges closer to the $1900 price range, sparking renewed interest from investors.

Currently trading around $1890 per unit (at the time of writing), Ethereum continues to hold its position as the second-largest cryptocurrency by market capitalization, boasting a massive $277 billion market cap. While transaction volumes have seen a slight dip, the overall sentiment around ETH seems to be improving, potentially influenced by the broader market recovery fueled by Bitcoin’s recent bull run.

Decoding the Whale’s Profit Playbook

Let’s delve deeper into this particular whale’s trading behavior. Lookonchain’s analysis reveals some fascinating insights:

- Consistent Profitability: This whale has an impressive track record, making over $14.5 million in profit from seven completed trades.

- High Win Rate: With an 85.7% win rate, this trader demonstrates a keen understanding of market timing and strategic entry and exit points.

- Buying Low, Selling High: The analytics platform emphasizes that this whale consistently buys ETH when prices are low and sells when they peak, a classic and effective trading strategy.

- Recent Accumulation: Over the past couple of days, this whale has withdrawn a total of 27,714 ETH from Binance, valued at nearly $47 million, at an average price of $1,857. This substantial accumulation further underscores their potential bullish stance on Ethereum.

Read Also: Ethereum Soar Close To $1,900

What Does This Mean for Ethereum and You?

While whale movements don’t guarantee price surges, they definitely offer valuable clues about market sentiment and potential future trends. This significant ETH withdrawal by a consistently profitable whale, coupled with Ethereum’s recent price recovery, could be interpreted as a positive sign for ETH holders and potential investors.

Key Takeaways:

- A major Ethereum whale withdrew $15.9 million worth of ETH from Binance.

- This whale has a history of profitable ETH trading and a high win rate.

- Ethereum’s price has been showing signs of recovery, aligning with broader market trends.

- Whale activity can provide insights into market sentiment and potential future price movements.

As always, the cryptocurrency market is volatile, and past performance is not indicative of future results. However, keeping an eye on whale activity, like this Ethereum transaction, can be a valuable part of your market research and understanding of the dynamic crypto landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.