BTC has again pushed above the $20,000 mark this week raising alarm among investors. Some of them have anticipated this to be a bull trap; whereas, a handful of them say that the market is headed for a $30,000 price point. Here’s what happened this week to help better understand the sentiments prevailing right at this moment!

No More Catalysts

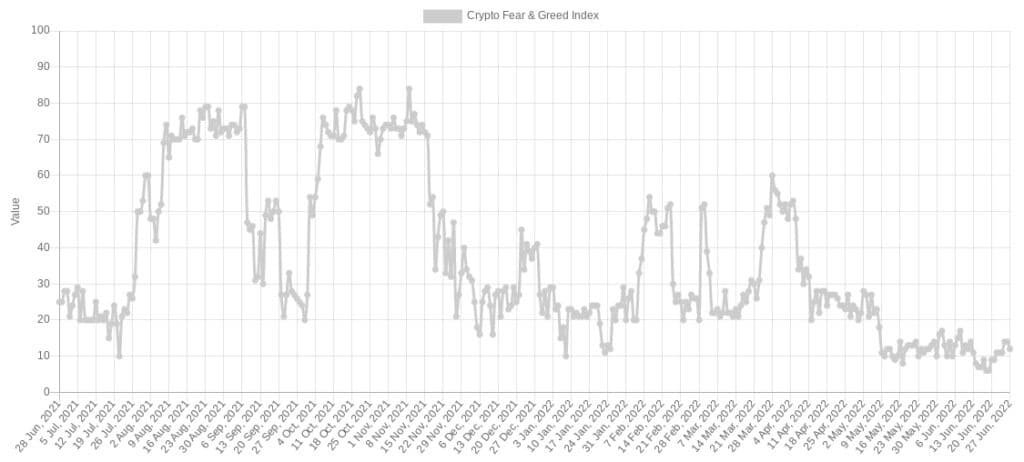

False signals apparently since Fed’s tapering doesn’t seem to settle. 75 basis point upgrade means the Greed and Fear Index is at its all time low and it could further dip. Despite the market reversal, BTC will trade in between 12k to 20K levels. Risky assets will further feel the jolt as we move forward.

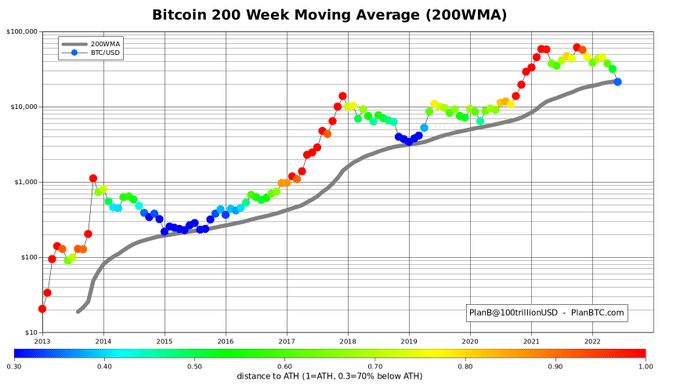

Weekly MA Takes a Jolt

The weekly 200 Day MA has been down for the first time below its support. This has never happened in the past. Since when the halvening approaches, there’s more buying in anticipation of a break out. However, if BTC fails below 20K, it would invalidate all past movements and set the tone for more bleeding ahead!

BTCs Dominance

Dominance dwindled like a house of cards in 2022, slipping from 60% to 43% at the time of writing. It is good and bad both since the crypto market is stabilizing.

BTC Rhetoric is Back

BTC is dead! The rhetoric returns again and so does the trading volume! Though it may be hard to digest for most investors, bearish events have driven maximum adoption while looking at the past.

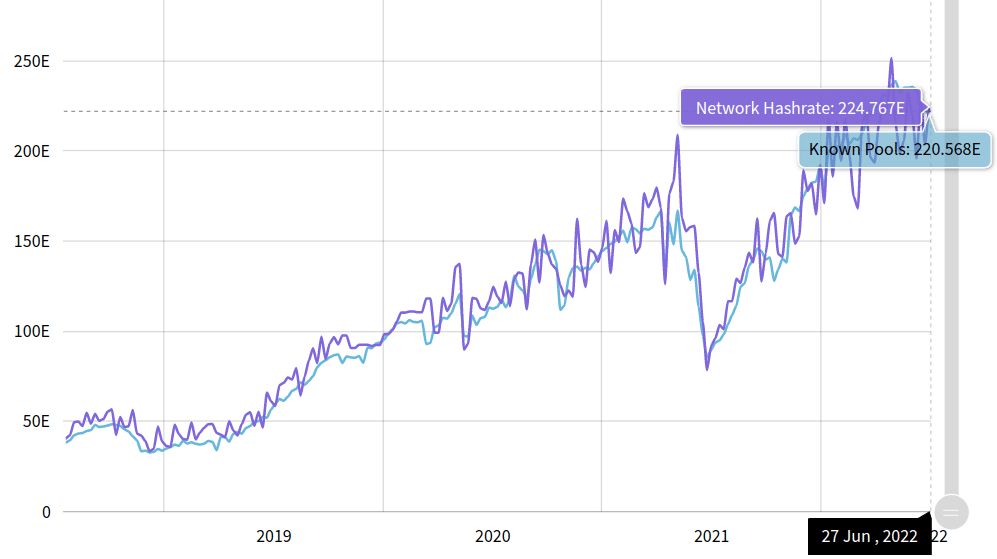

There has been a lot of searches lately that BTC is dead. Primarily most of them must be done at the hands of the SEC jokingly. But joke or no joke, we are indeed seeing massive adoption with new wallet creation and mining activities remaining steady despite the bear market!