Ronin (RON), the token powering the Ronin Network, experienced a rollercoaster ride in the past 24 hours, rallying to a two-year high before it plunged nearly 30% after its listing on Binance.

This dramatic price swing has raised questions about potential market manipulation and the long-term viability of the project.

From Hero To Zero: A Short-Lived Rally

On February 5th, RON enjoyed a meteoric rise, surging 15% to reach a peak of $3.54.

This rally was fueled by investor optimism surrounding the network’s growing user base and address activity. Trading volume spiked to $80 million, signifying increased market participation.

See Also: Dymension (DYM) Gains 58% In First Day After Airdrop

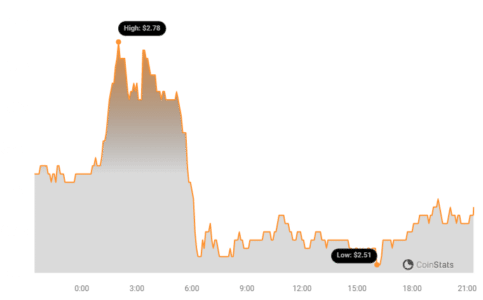

However, the euphoria was short-lived. Coinciding with the Binance listing announcement, the price began a precipitous decline five hours after trading commenced on the exchange.

By today, RON has shed nearly 30% of its value, currently trading at $2.54. This drop marks a breach of the crucial $3 support level, which the token had recently reclaimed after 14 months.

Negative Sentiment And Selling Pressure Mount

Social media sentiment surrounding RON mirrored the price action.

Santiment data (chart below) reveals a 250% increase in social volume within 24 hours, but with a concerning shift towards bearishness. Negative sentiment spiked from 0.87 to 5.58, reflecting growing investor concerns.

This negativity translated into significant selling pressure, with 24-hour trading volume soaring 275% to $203 million. Market participants, eager to offload their holdings, contributed to the downward spiral.

Binance Under Scrutiny: Pump And Dump Allegations

The timing of the price surge and subsequent crash has fueled speculation of a “pump and dump” scheme, with some accusing Binance of complicity.

While no concrete evidence has surfaced, Yi He, Binance’s co-founder, acknowledged the concerns and announced a $5 million bounty program to expose any corrupt employees involved in such activities.

Future Uncertain: A Cautious Outlook

Despite the recent setback, RON still stands at a 23-month high compared to February 2022. However, the future remains uncertain.

The sharp drop, shifting sentiment, and potential manipulation allegations have cast a shadow over the project’s prospects.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN