Buckle up, crypto enthusiasts! The escalating tensions between Russia and Ukraine sent shockwaves through the global markets on February 22nd, and Bitcoin (BTC) wasn’t spared. If you were watching the charts, you witnessed Bitcoin taking a nosedive, hitting lows we haven’t seen since early February. Let’s dive into what triggered this market dip and what it means for the future of crypto in times of geopolitical uncertainty.

Bitcoin’s Wild Ride: Ukraine Crisis Triggers Price Drop

Just how low did Bitcoin go? TradingView data from Bitstamp revealed BTC/USD plunged to a staggering $36,400 overnight on Tuesday. That’s a significant drop, marking the lowest point since February 3rd.

Source : TradingView

The volatility was palpable as Russian President Vladimir Putin addressed the Ukraine situation for nearly an hour. His speech culminated in the recognition of two breakaway republics in eastern Ukraine, followed by the deployment of Russian troops into these regions – territories still internationally recognized as Ukrainian. This move intensified fears of a full-scale conflict, sending ripples across traditional and crypto markets alike.

The immediate aftermath? A market-wide tumble, with stocks and other risk assets feeling the heat. Russian companies bore the brunt of the sell-off. Adding fuel to the fire, the Russian Ruble experienced a dramatic plunge, breaching the 80-per-dollar mark and inching closer to its 2016 lows of 85.6.

Source: Holger Zschaepitz/ Twitter

Safe Haven Showdown: Gold vs. Bitcoin

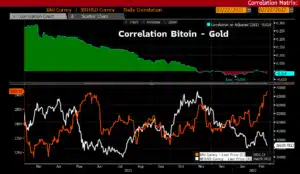

Interestingly, while Bitcoin struggled, gold emerged as a surprising victor. It bucked the trend, holding onto its safe-haven appeal amidst the market turmoil. As of writing, XAU/USD (Gold) was up over 6% year-to-date, a stark contrast to BTC/USD, which was down by 23% in the same period.

According to financial analyst Holger Zschaepitz, investments in gold-backed Exchange Traded Funds (ETFs) saw an increase in February, highlighting gold’s traditional role as a safe store of value during uncertain times.

For Bitcoin traders, the focus squarely shifted to Russia on Monday, as anxieties cast a shadow over Asian markets. This geopolitical event underscores a crucial question in the crypto space: Is Bitcoin truly a safe-haven asset like gold, especially when geopolitical storms gather?

Bitcoin’s Safe-Haven Narrative Under Scrutiny

For years, a narrative has been building around Bitcoin as a digital gold – a decentralized, inflation-resistant asset that can act as a safe haven during economic and political instability. However, recent events, particularly the Russia-Ukraine crisis, are prompting a re-evaluation of this narrative.

Why is Bitcoin reacting like a risk asset and not a safe haven in this crisis? Several factors could be at play:

- Market Maturity & Correlation: The crypto market, while growing, is still relatively young compared to traditional markets like gold. Bitcoin’s price action often shows a higher correlation with tech stocks and risk-on assets. In times of panic, investors tend to liquidate riskier assets first, and Bitcoin, despite its ‘digital gold’ aspirations, can fall into this category.

- Liquidity Needs: During periods of heightened uncertainty, investors often seek liquidity. Selling off more volatile assets like Bitcoin can provide that liquidity, even if they are perceived as long-term safe havens.

- Geopolitical Uncertainty vs. Economic Crisis: Bitcoin’s safe-haven narrative may be more strongly tied to economic crises and inflation concerns. Geopolitical events, like the Russia-Ukraine conflict, can trigger broader market panic and risk aversion, impacting even assets perceived as safe.

- Regulatory Concerns: Geopolitical instability can also amplify regulatory uncertainty around cryptocurrencies. Governments might react to crises with stricter regulations, adding downward pressure on crypto prices.

Gold’s Enduring Safe-Haven Status

In contrast to Bitcoin, gold has a long-established history as a safe-haven asset. Its perceived value is rooted in:

- Tangible Asset: Gold is a physical, tangible asset with intrinsic value. This contrasts with Bitcoin, which is purely digital and relies on network consensus and technology.

- Decades of Trust: Gold has been a store of value for centuries, weathering countless economic and political storms. This historical track record instills greater trust in gold during crises.

- Lower Volatility (Generally): While gold prices do fluctuate, they are generally less volatile than Bitcoin, making it a more comfortable safe haven for risk-averse investors during turbulent times.

What’s Next for Bitcoin and the Crypto Market?

The Russia-Ukraine situation is still unfolding, and its long-term impact on Bitcoin and the broader crypto market remains to be seen. Here are some key things to watch out for:

- Sanctions and Financial Impact: The severity and impact of Western sanctions on Russia will be crucial. These sanctions could further destabilize the Russian economy and potentially impact global financial markets, indirectly affecting crypto.

- Russian Crypto Regulation: Interestingly, while the Russian Central Bank has been advocating for a ban on crypto, there have been reports of the Russian government considering crypto as a way to circumvent potential sanctions. Any shift in Russian crypto policy could have significant implications.

- Broader Market Sentiment: Overall market sentiment will play a significant role. If the Russia-Ukraine crisis escalates further, risk aversion is likely to increase, potentially putting further downward pressure on Bitcoin and other cryptocurrencies.

- Long-Term Crypto Adoption: Despite short-term volatility, the fundamental drivers of crypto adoption – decentralization, digital scarcity, and potential for financial innovation – remain. Geopolitical events, while causing immediate market reactions, may not necessarily derail the long-term growth trajectory of the crypto market.

Actionable Insights for Crypto Traders

Navigating the crypto market during geopolitical uncertainty requires a cautious and informed approach. Here are a few actionable insights:

- Diversification is Key: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes, including traditional assets and potentially even gold, to mitigate risk.

- Manage Risk Wisely: Use stop-loss orders and manage your position sizes carefully, especially during periods of high volatility.

- Stay Informed: Keep a close eye on geopolitical developments and market news. Understanding the macro context is crucial for making informed trading decisions.

- Long-Term Perspective: Remember that crypto markets are inherently volatile. Focus on the long-term potential of your crypto investments and avoid making impulsive decisions based on short-term market fluctuations.

In Conclusion: Bitcoin’s Resilience Will Be Tested

The Russia-Ukraine crisis has thrown a spotlight on Bitcoin’s role as a safe-haven asset. While the recent price drop raises questions, it’s important to remember that the crypto market is still evolving. Geopolitical events introduce new layers of complexity and volatility. Whether Bitcoin can truly emerge as a reliable safe haven in the face of such crises remains to be seen. However, the underlying technology and the growing adoption of cryptocurrencies suggest that Bitcoin and the crypto market are here to stay. The current situation serves as a crucial test of Bitcoin’s resilience and its ability to navigate the complexities of the global stage. Keep learning, stay vigilant, and remember – in the world of crypto, volatility is often accompanied by opportunity.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.