Bitcoin has seen a rapid rally over recent weeks from the $10,000 range to $16,000 as of this article’s writing. The leading cryptocurrency is expected to move even higher in the weeks and months ahead as long-term trends are still positive.

Analysts are highlighting a confluence of technical and fundamental reasonings as to why BTC will likely move higher in the future.

Analysts are eyeing a strong Bitcoin rally as key long-term technical trends show through.

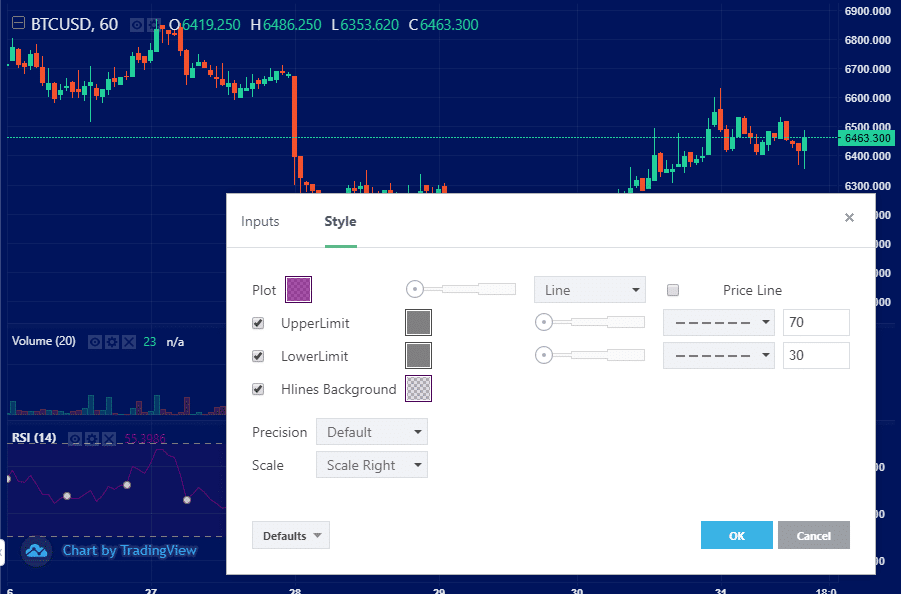

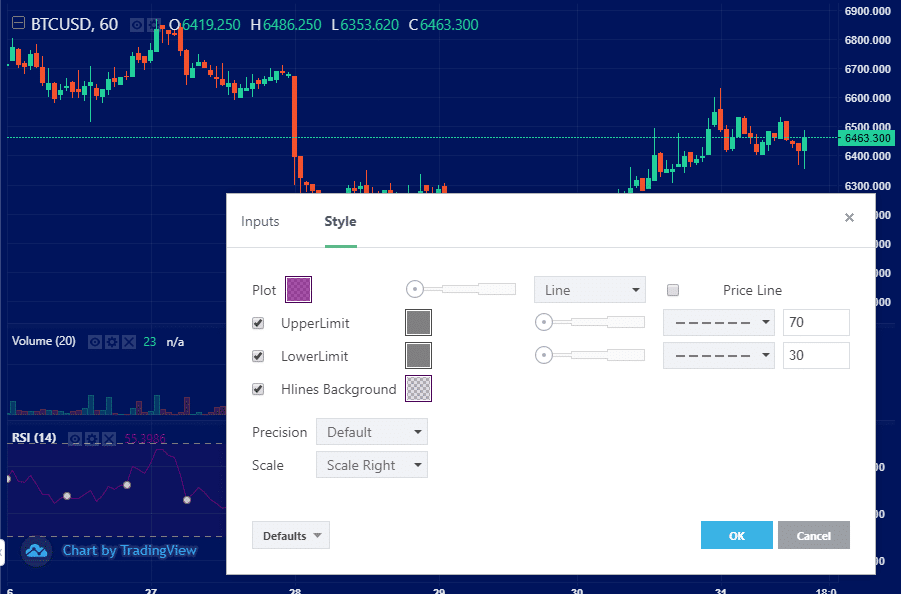

Pseudonymous quantitative analyst “PlanB” recently shared the chart below, which shows that Bitcoin’s one-week RSI is about to cross above a historical bull market level. This should result in an extremely strong rally in the months ahead if the price holds that level:

“If you missed 2013 and 2017 bull markets: current #bitcoin price rise to $16K is just a small taste of what will come next. We are just warming up.”

Josh Rager, a cryptocurrency trader, recently shared the chart seen below. It shows that Bitcoin is likely to rally 700-1,000% in the upcoming bull run as Bitcoin seems primed to set a new all-time high on a monthly basis:

“Every time BTC has closed above the previous monthly all-time high – a 700% to 1000% uptrend has followed. November could be the first monthly close that we see breaking the previous high and historically that’s been a very bullish sign for the crypto market”

The devaluation of the U.S. dollar and a relative rally in Bitcoin against gold is expected to push prices higher.