Overview:

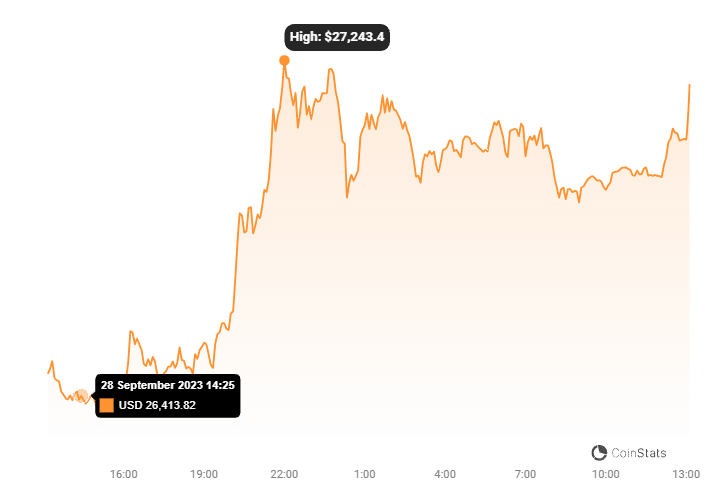

Bitcoin remains in a consolidation phase, hovering above the crucial $26,000 support mark. As the price trades below the $26,400 level and the 100 hourly Simple Moving Average (SMA), a major bearish trend line with resistance near $26,300 can be observed. The cryptocurrency’s performance suggests a recovery may be in the offing unless a decisive move is below $26,000.

Key Highlights:

- Support Base Formation: Bitcoin is building short-term support above the $26,000 level, suggesting a potential upward move unless this support is breached.

- Recent Price Action: Bitcoin tried to push past the $26,200 mark recently but was met with resistance as bearish sentiment persisted below $26,500.

- Key Resistance Levels: Immediate resistance is spotted at $26,300, in line with the bearish trend line on the hourly chart. A breach of this could see the price challenge the $26,500 resistance, beyond which a move towards $27,000 becomes likely.

- Potential Downward Scenario: A further downward move is plausible if Bitcoin fails to rise above the $26,300 resistance level. Immediate support stands at $26,050, and a break below the vital $26,000 mark might accelerate losses, with subsequent support at $25,400 and then a potential move towards the psychological $25,000 level.

Technical Indicators:

- MACD: The Moving Average Convergence Divergence (MACD) indicator suggests that bearish momentum may wane.

- RSI: The Relative Strength Index (RSI) hovers around the 50 level, suggesting a balanced momentum with neither a strong bearish nor bullish bias.

Conclusion:

Bitcoin’s recent price action underscores its resilience above the $26,000 support mark. As the digital asset tests key resistance levels, its trajectory in the near term will likely be determined by its ability to break above the $26,300-$26,500 range or decline below the crucial $26,000 mark. Investors and traders should closely watch these pivotal levels and the mentioned technical indicators for more clarity on Bitcoin’s next move.