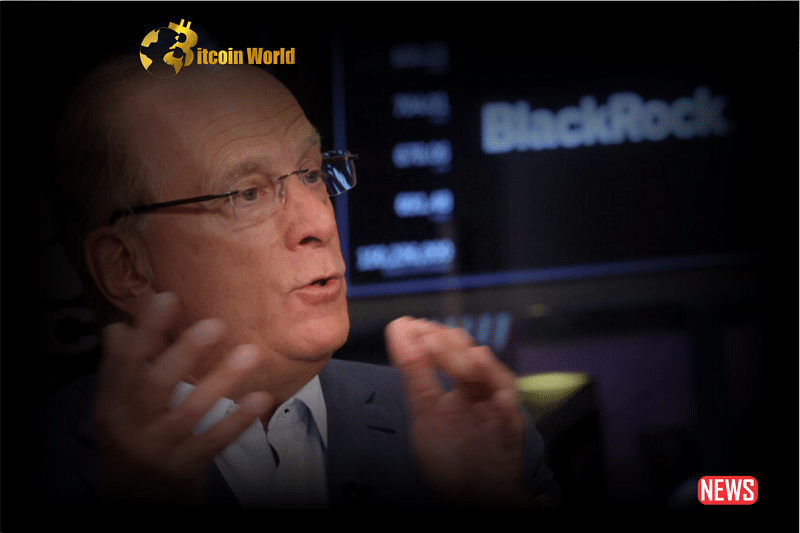

Larry Fink, CEO of BlackRock, made significant statements on Bitcoin (BTC) during a live Fox Business show. Fink referred to Bitcoin as “digital gold” and stressed its significance as an international asset. He indicated an interest in hearing from regulators about the Bitcoin ETF.

It is important noting that Fink’s position on Bitcoin has shifted. In 2017, he referred to Bitcoin as a “money laundering index.” However, in March 2022, he notified shareholders that BlackRock was aggressively researching digital currencies, stablecoins, and their underlying technology to evaluate their potential consumer benefits. He emphasized the potential for a well-designed global digital payment system to improve international transactions while reducing the risks of money laundering and corruption.

Fink elaborated, saying, “I believe the role of cryptocurrencies in many ways is to digitize gold.” As an international asset, BTC can be used as an alternative to investing in gold, acting as a hedge against inflation and currency depreciation. Because Bitcoin is not tied to one currency, it can be a versatile asset for people.”

Regarding the Bitcoin ETF, Fink emphasized BlackRock’s commitment to working with authorities and analyzing all relevant aspects of any application. While he couldn’t get into specifics regarding the application, he hoped cryptocurrency would become more accessible and cost-effective for investors. Fink stressed the importance of addressing the crypto market’s huge buy-sell spreads, which are now eroding a significant amount of prospective returns. He thinks regulators will see these applications as a way to democratize cryptocurrency.

It is crucial to note that the previous words are not intended to be investment advice but rather a summary of Larry Fink’s comments on Bitcoin and its future position in the economic environment.