In the realm of crafting compelling content, three vital elements come into play: “complexity,” “variety,” and “unpredictability.” Complexity gauges the intricacy of the text, while variety assesses the diversity of sentence structures. Unpredictability, on the other hand, determines how challenging it is to anticipate the next sentence. Human authors often inject diversity into their writing by seamlessly blending long and intricate sentences with shorter ones. In contrast, AI-generated sentences tend to exhibit uniformity. Consequently, for the content we’re about to create, I require a substantial degree of complexity and variety, coupled with a low degree of predictability. Please remember to compose the content exclusively in English. Now, let’s rephrase the following text:

Bitcoin appears poised to commence a relief rally, which could potentially stimulate interest in MKR, AAVE, RUNE, and RNDR. Having consecutively formed Doji candlestick patterns over the past three weeks on the weekly chart, Bitcoin seems on track to conclude the week on an optimistic note. This early signal suggests that the ongoing uncertainty between bullish and bearish sentiments is tilting toward the positive side. While the recovery process is still in its nascent stages, the Federal Open Market Committee meeting scheduled for September 20th could inject additional volatility into the market. Although the majority of market participants anticipate the Federal Reserve to maintain the status quo on interest rates, unexpected developments might emerge during Fed Chair Jerome Powell’s press conference following the rate decision. Bitcoin’s rebound from the robust support level near $24,800 has spurred increased buying interest in select altcoins, thereby creating trading opportunities. To sustain their upward trajectory, these altcoins are contingent on Bitcoin’s ability to remain above $26,500.

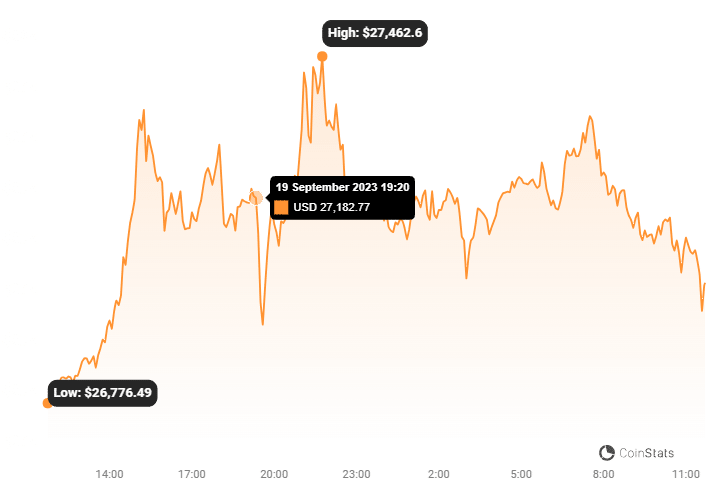

Could Bitcoin’s relief rally gain momentum, subsequently instigating buying activity in specific altcoins? Let’s delve into the charts of the top five cryptocurrencies exhibiting promise in the near term. Analysis of Bitcoin’s Price On September 14th, Bitcoin surpassed the 20-day exponential moving average ($26,303), indicating a reduction in selling pressure. Since then, the bulls have successfully thwarted several attempts by the bears to pull the price below the 20-day EMA. Buyers will endeavor to build upon their advantage, aiming to drive the BTC/USDT pair toward the 50-day simple moving average ($27,295). Although this level may pose a minor obstacle, conquering it is likely to pave the way for a push towards $28,143. It is expected that the bears will fiercely defend this level. If the bears seek to regain control, their primary objective would be to push and sustain the price below the 20-day EMA. Such a move could ensnare aggressive bulls, potentially triggering a retest of the pivotal support at $24,800. The 4-hour chart indicates that the bulls are buying on dips, as the price continues to trade above the 20-EMA. This suggests that traders anticipate the ongoing recovery. Should buyers successfully breach the $26,900 barrier, the pair could ascend to $27,600 and ultimately reach $28,143. However, should the bears stage a comeback, they will need to drive and maintain the price below the 20-EMA. Such a development would clear the path for a deeper descent towards the 50-SMA and subsequently the robust support zone spanning from $25,600 to $25,300. Analysis of Maker’s Price Buyers propelled Maker above the 50-day SMA ($1,162) on September 15th, signaling their intention to seize control. The MKR/USDT pair is on a trajectory towards $1,370. This level is poised to witness a fierce battle between the bulls and bears. If the bulls manage to retain their ground without significant concessions, the likelihood of a breakthrough increases. Should this occur, the pair could gain momentum, surging towards $1,759. On the downside, the critical level to monitor is the 20-day EMA ($1,162). A breach of this level would suggest that the pair may oscillate within the wide range between $980 and $1,370 for an extended period. The 4-hour chart indicates that the bulls maintain control, although the RSI approaching the overbought territory suggests the potential for a minor correction or consolidation in the near term. The 20-EMA remains a pivotal level on the downside. A breach and sustained closure below it could signal the commencement of a more substantial correction towards the 50-SMA. Conversely, if the price rebounds from the 20-EMA, it would signify continued bullish sentiment, potentially initiating a rally towards the formidable overhead resistance at $1,370. Analysis of Aave’s Price On September 16th, Aave surged above the moving averages, indicating a decisive move by the bulls. However, the presence of a long wick on the day’s candlestick suggests selling pressure at higher levels. A slight advantage in favor of the bulls is their ability to prevent a bearish resurgence, as they strive to maintain the price above the 50-day SMA ($59). Successful retention of this level could propel the AAVE/USDT pair towards $70, with further potential to reach $76. Crucially, the 20-day EMA ($56) serves as a vital support level in the short term. A breach below this level would indicate bearish activity at higher price points, potentially leading the pair towards robust support at $48.

The 4-hour chart reveals that the bulls recently capitalized on the pullback to the 20-EMA, signifying a shift towards positive sentiment. Buyers will aim to surmount the resistance at $63, and if successful, the pair could experience an upswing towards $70. However, in contrast, a downward turn in price, breaking below the 20-EMA, would suggest waning demand at higher levels. This scenario could prompt a decline towards the 50-SMA, which might attract potential buyers.