According to Chainalysis, 4068 criminal whales (approximately 4% of all whales) are in possession of more than $25 billion in cryptocurrencies.

Criminal whales, according to the blockchain analytics firm, are any private wallet that owns more than $1 million in cryptocurrency and receives more than 10% of its funds from illicit addresses linked to scams, fraud, and malware.

The information comes from the Crypto Crime Report’s “Criminal Balances” section, which looks at criminal behavior on the blockchain in 2021 and early 2022. Ransomware, Malware, Darknet markets, and NFT-related criminality are among the subjects covered in the comprehensive research.

“Overall, Chainalysis has identified 4,068 criminal whales holding over $25 billion worth of cryptocurrency.”

” Criminal whales represent 3.7% of all cryptocurrency whales — that is, private wallets”

” holding over $1 million worth of cryptocurrency,” the report reads.

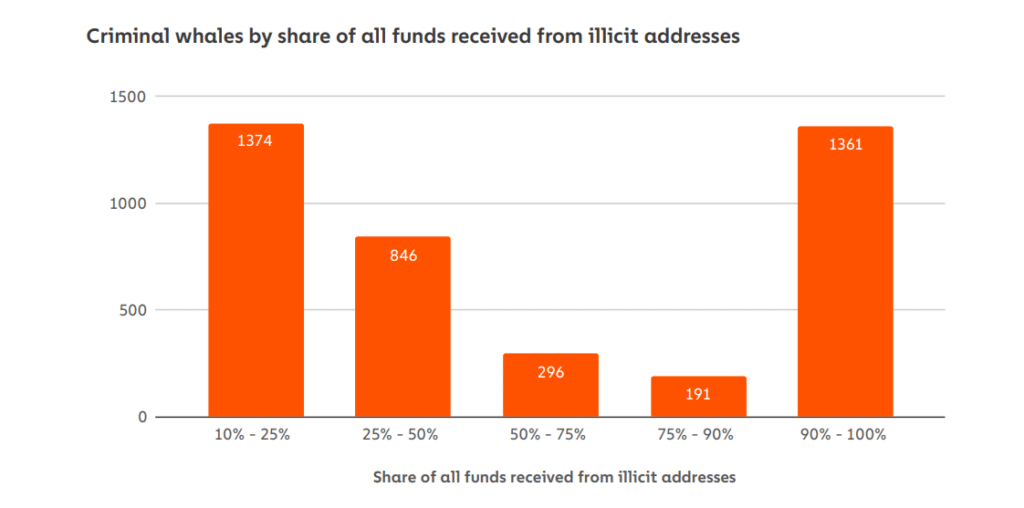

The data revealed that 1,374 whales had obtained between 10%. Then, and 25% of their balance via shady sources, while 1,361 already between 90% and 100%. There were 1,333 criminal whales with illicit financial balances of 25 percent to 90 percent.

“While stolen monies account for the majority of criminal balances, darknet markets are the leading source”

“of illicit funds supplied to criminal whales, with scams coming in second and stolen funds coming in third,”

That’s, according to the report.

Percentage of whale balance via illicit addresses: Chainalysis

In terms of illegal transaction activity, the research found that criminal addresses got more than $14 billion in 2021. That’s, up from $7.8 million in 2020.

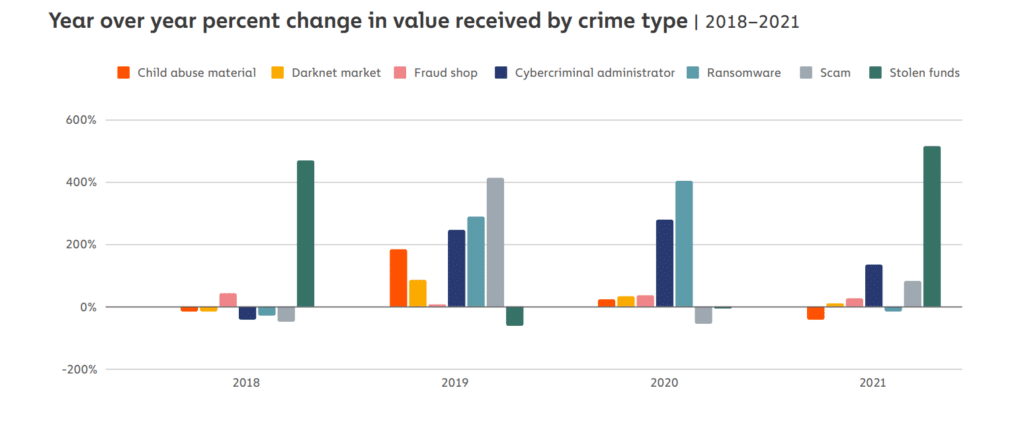

Value received via type of crypto crime: Chainalysis

Scamming accounted for the lion’s part of the $14 billion number last year. Thereby, accounting for $7.8 billion, up 82 percent year over year. Rug pulls by Decentralized Finance (DeFi) were singled out as a major source of fraud. That’s, with a total value of $2.8 billion.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…