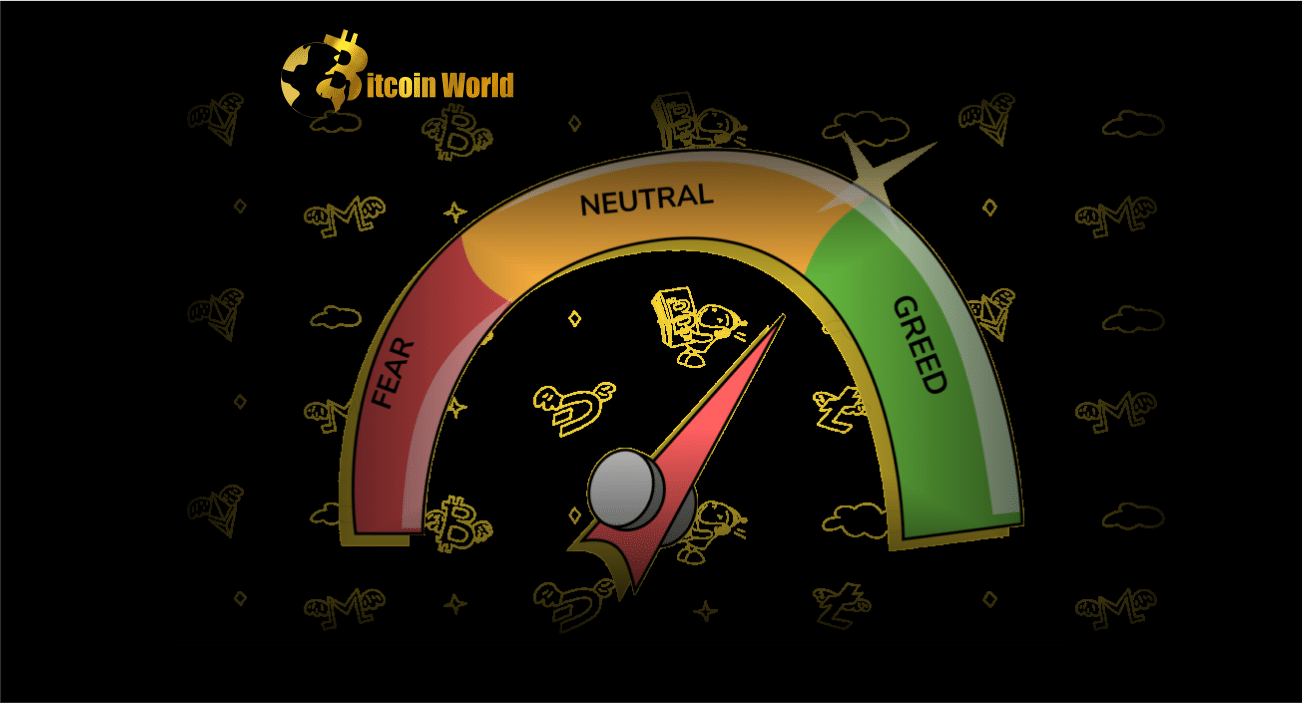

The Crypto Fear and Greed Index, which aggregates investor confidence and market attitude, has achieved its highest level this year, showing increased optimism and confidence among cryptocurrency investors.

The indicator, which runs from 0 to 100 and is dependent on variables such as volatility and trade volume, has risen to a level not seen since November 2021, when Bitcoin reached an all-time high near $70,000.

The index shows that cryptocurrency investors are currently in a state of “greed,” with a score of 68. The indicator fell to a low of 6 last year following the collapse of FTX, which caused the price of bitcoin to fall below $18,000.

The index’s gain coincides with a surge in the price of the flagship cryptocurrency Bitcoin, which has outperformed traditional risk assets such as shares. Bitcoin is currently trading at $28,200, having risen more than 30% in less than a week.

While a high Crypto Fear and Greed Index may reflect optimistic emotion, experts warn that it should not be used as the sole determinant of investing decisions. Before making any investing selections, investors must undertake extensive study and consider a number of aspects.

According to CryptoGlobe, a recent Goldman Sachs analysis stated that Bitcoin is the best performing asset year to date, outperforming both gold and the stock market’s benchmark index, the S&P 500.

Stock prices have been falling as investors seek protection amid the American banking crisis. Increasing interest rates and inflation have caused the demise of banks such as Silicon Valley Bank (SVB) and Signature Bank, which have recently been joined by Credit Suisse, a 167-year-old bank acquired by UBS in a deal backed by the Swiss National Bank.

The Federal Reserve has been boosting interest rates to combat inflation, leaving banks that invested in low-interest-rate bonds some years ago with a difficult choice: sell bonds at a loss to pay withdrawals or raise cash elsewhere.

SVB’s fall was the largest bank failure since the 2008 financial crisis, sending shockwaves through global financial markets. The $3.25 billion bailout of Credit Suisse by UBS was also a significant event in the banking sector.

Cory Klippsten, CEO of bitcoin financial services startup Swan Bitcoin, recently stated that BTC is “the index” and that there is no reason to “gamble on altcoins,” calling it a call option on all future cryptocurrency technology.