Hold onto your hats, crypto enthusiasts! Ethereum (ETH) is making waves again, breaking past the $3,200 mark for the second consecutive day. If you’ve been watching the market closely, you’ll know this isn’t just a minor blip – ETH even touched $3,250, showcasing impressive momentum. Let’s dive into what’s fueling this surge and what to expect next for the world’s second-largest cryptocurrency.

Ethereum’s Upward Trajectory: What’s Driving the Price?

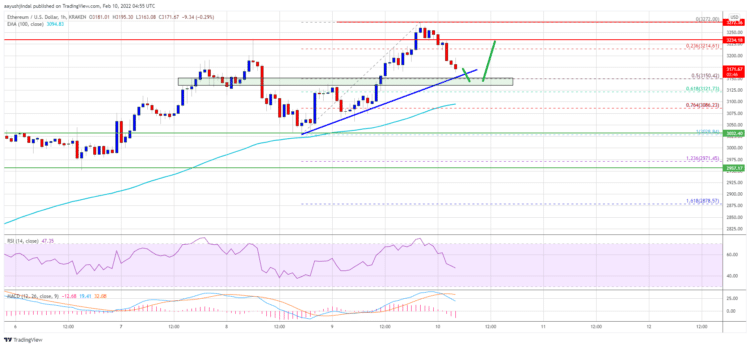

For the past couple of days, Ethereum has shown remarkable strength. After surpassing $3,200, ETH continued its ascent, briefly exceeding $3,250. This bullish momentum is clearly reflected in the technical indicators. For instance, the price comfortably settled above the 100 hourly simple moving average, a key indicator often watched by traders to gauge short-term trends.

Near $3,272, a high was made, and the price is now correcting gains. It is currently trading below the $3,200 level of support. Ether fell below the 23.6 percent Fib retracement line of the latest rise from the swing low of $3,028 to the high of $3,272.

The price, however, continues to trade above $3,150 and the 100 hourly simple moving average. On the hourly chart of ETH/USD, a big bullish trend line is forming with support near $3,150.

Source: TradingView.com

Key Resistance and Support Levels to Watch

As with any cryptocurrency, understanding resistance and support levels is crucial for navigating the market. Currently, Ethereum faces immediate upside resistance near the $3,220 mark. Let’s break down these levels:

- Immediate Resistance: $3,220. This is the first major hurdle for ETH to overcome.

- Strong Resistance: $3,250. A decisive close above this level could signal a significant shift towards a stronger upward trend.

- Potential Upside Targets: $3,280 and $3,300. If the bulls maintain momentum, these levels are within reach.

- Next Major Resistance: $3,400. Looking further ahead, $3,400 represents a significant level that bulls will aim to conquer.

However, it’s not all smooth sailing. Ethereum needs to overcome these resistance levels to solidify its bullish trend. What happens if it doesn’t?

Potential Downside Correction: Support Zones

If Ethereum struggles to break past $3,220 or $3,250, we might see a corrective phase. Here are the key support levels to keep an eye on:

- Initial Support: $3,150 and the Trend Line Zone. This area provides the first line of defense against a downward correction.

- Fibonacci Retracement Level: 50% Fib retracement of the recent rise from $3,028 to $3,272. This level coincides with the trend line and adds confluence to the support zone.

Essentially, the $3,150 level is a critical juncture. If ETH holds above this, the bullish momentum could still be intact. However, a break below this level might signal a deeper correction.

Ethereum’s Price Action: Key Takeaways

To summarize the current Ethereum price action:

- Bullish Momentum: Ethereum has shown strong upward movement, surpassing $3,200 and briefly hitting $3,250.

- Resistance Ahead: $3,220 and $3,250 are key resistance levels that need to be broken for further gains.

- Support in Place: $3,150 and the trend line zone offer crucial support to prevent deeper corrections.

- Watch the Trend Line: The bullish trend line forming near $3,150 is a significant indicator of ongoing upward pressure.

Near the $3,220 mark, there is immediate upside resistance. The $3,220 level is the first big resistance. A good close above $3,250 could signal the start of a new upward trend. In the above scenario, the price could rise above $3,280 and $3,300. The bulls’ next significant resistance level could be around $3,400.

If ethereum fails to rise beyond $3,220 or $3,250, a negative correction could begin. On the downside, the $3,150 level and the trend line zone provide initial support.

The trend line is also around the 50% Fib retracement level of the current rise from the swing low of $3,028 to the high of $3,272.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

What Does This Mean for Ethereum’s Future?

Ethereum’s recent price surge is encouraging for investors and the broader crypto market. Whether this is the start of a sustained bull run or a temporary rally remains to be seen. Keep a close watch on the key resistance and support levels mentioned. A break above $3,250 with sustained volume could signal a more significant bullish phase, potentially targeting higher levels. Conversely, failure to hold support at $3,150 could lead to further downside.

Disclaimer: Cryptocurrency investments are highly volatile and carry risk. This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.