- New Zealand central bank governor, Adrian Orr, has raised a red flag on stablecoins, stating that the stability of stablecoins depends on the issuer’s financial health, and their balance sheet.

- The New Zealand central bank governor called stablecoins as “oxymorons” due to their perceived stability.

Adrian Orr, the governor of the New Zealand central bank has raised major concerns over digital assets, especially stablecoins. He added that the fiat-pegged stablecoins can in no way be a substitute for real fiat money.

Stablecoins’ Stability Misconception

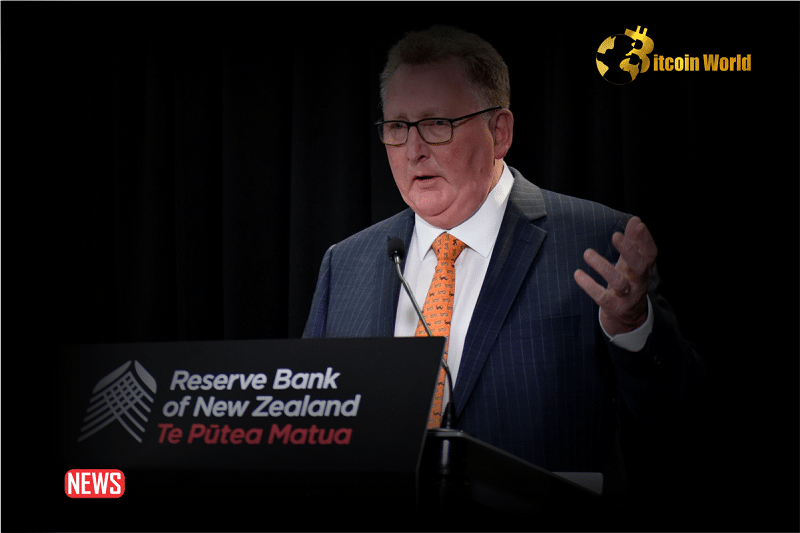

Adrian Orr, Governor of the Reserve Bank of New Zealand, cautioned against the perceived stability of stablecoins, labeling them as “the biggest misnomers” and “oxymorons.”

Orr made these remarks during a parliamentary committee session held on Monday in Wellington, shedding light on the inherent risks associated with stablecoins.

Contrary to their name, stablecoins, which are crypto tokens pegged to other assets, do not always maintain a stable value, Orr emphasized.

He pointed out that the stability of stablecoins hinges solely on the financial health of the entity backing them, highlighting the reliance on the issuer’s balance sheet.

See Also: ‘Almost All Financial Scams Are Now Crypto-themed’ – Russian Central Bank

Stablecoins typically rely on substantial reserves to uphold their value, but they remain vulnerable to disruptions in the traditional financial landscape.

Some top central banks have already raised concerns about the potential of stablecoins to introduce instability into real-world markets in response to economic challenges.

Furthermore, the governor of New Zealand’s central bank said that if not monitored, stablecoins could potentially undermine the global financial system.

“Mostly in that what is advertised on the tin is not what is in the tin for these purported alternatives to central bank cash,” he said.

Bitcoin’s Limitations As Currency

Adrian Orr also challenged the notion of Bitcoin’s utility as a mainstream currency during a recent discussion.

Orr contended that Bitcoin falls short in fulfilling the fundamental functions of a currency, namely serving as a reliable means of exchange, a stable store of value, and a unit of account.

Despite its popularity and widespread use in certain circles, Orr emphasized that Bitcoin lacks the necessary attributes to function effectively as a currency.

He further noted that while Bitcoin may serve alternative purposes, it cannot replace or even complement traditional central bank money.

See Also: No Crypto Ad In Super Bowl But Jack Dorsey Spotted In ‘Satoshi’ Shirt

Orr highlighted the essential role of fiat currencies like the New Zealand dollar, attributing their credibility to the backing of legislative authority and the oversight of reputable institutions such as independent central banks.

He underscored the importance of maintaining low and stable inflation, a responsibility typically entrusted to central banks, in ensuring the stability and reliability of fiat currencies.

#Binance #WRITE2EARN