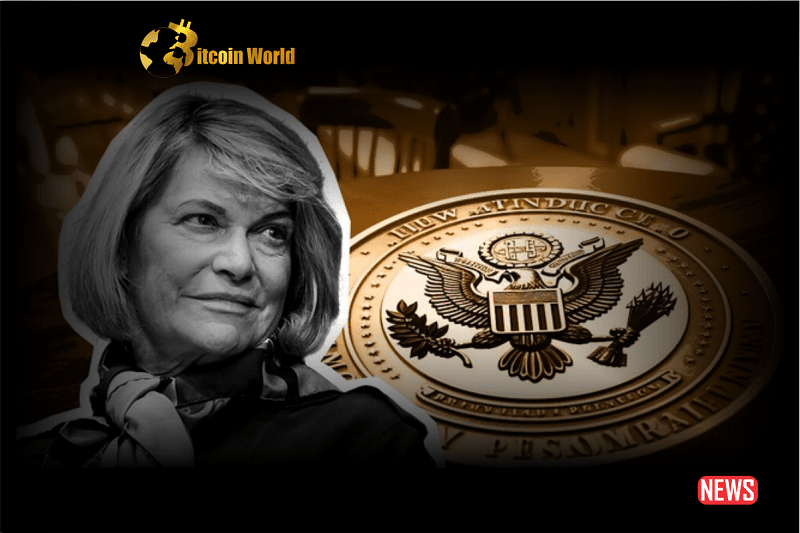

The crypto-savvy United States Senator, Cynthia Lummis, entered the fray with an amicus brief, throwing her weight behind Coinbase’s bid to dismiss the U.S. Securities and Exchange Commission (SEC) lawsuit against the platform. While not directly involved in the case, this legal maneuver carries significant implications as it amplifies the arguments in favor of Coinbase and underscores the broader impact of the lawsuit.

In her filing dated August 11, submitted to the U.S. District Court for the Southern District of New York, Senator Lummis underscored that this lawsuit transcends the typical realm of enforcement cases. She asserted that the SEC’s actions attempt to seize “primary influence” over the dynamic crypto sector at a critical juncture. The ongoing discussions in Congress and on the global stage regarding crypto asset regulation further intensify the significance of the SEC’s move, according to Lummis.

In a spirited defense of Congress’s prerogative, Lummis stated, “The Constitution empowers Congress—not the SEC—to legislate in such an area of profound economic and political significance.” She questioned the SEC’s inclination to assert such authority, mainly when numerous legislative proposals circulating in Congress are aimed at delegating regulatory powers to different agencies.

Coinbase’s motion to dismiss, submitted on August 4, positioned the SEC’s actions as a breach of due process and an abandonment of its prior interpretations of securities laws. Lummis’s amicus brief fortified these arguments, focusing on the SEC’s attempt to fit diverse crypto assets into the existing definition of a ‘security,’ a move she deemed exceeding the SEC’s authority. She highlighted the inherent contradiction in the SEC’s stance, accusing it of attempting to legislate through enforcement

Interestingly, Lummis is not alone in her stand. A coalition of influential crypto advocacy groups, comprising the Blockchain Association, Crypto Council for Innovation, Chamber of Progress, and Consumer Tech Association, jointly submitted their amicus brief on the same day. Marisa Tashman, Senior Counsel at the Blockchain Association, echoed Lummis’s sentiments, highlighting the risks posed by the SEC’s interpretation. She stressed that the SEC’s approach could inadvertently encompass non-security assets, a scenario that Congress likely never intended when granting regulatory authority to the SEC.

Senator Lummis’s amicus brief lends further weight to Coinbase’s plea for dismissal, adding a dimension of Congressional oversight and the potential overreach of regulatory authority to the discourse. In parallel, the involvement of prominent crypto advocacy groups underscores the industry’s collective concern over the SEC’s stance, propelling the lawsuit into a broader arena with implications that extend far beyond the courtroom.