In December 2021, Uniswap was installed on Polygon. However, just a few weeks later, the DeFi protocol has begun to eat into Polygon’s market share. According to the OurNetwork weekly, Uniswap held roughly 45 percent of the market share on Polygon at press time, up from around 20 percent in one week to nearly 30 percent in two weeks.

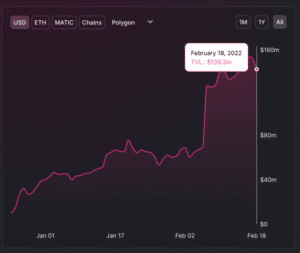

The total value locked [TVL] rose sharply in February 2022, reaching a high of $139.3 million on February 18th.

Source: DeFi Llama

This partnership is beneficial to more than just Uniswap. In fact, in the preceding month, Polygon received 2.36 million unique addresses. Polygon looks to be popular among gamers, since seven titles have over 10,000 monthly active players.

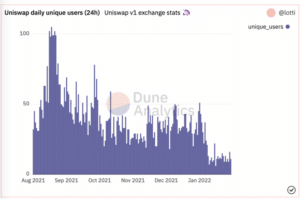

Sunflower Farmers was one such example, despite the fact that its publicity resulted in unbalanced revenue. QuickSwap, Sunflower Farmers, and SushiSwap, however, were much ahead of Uniswap, which had 16.6k users last week, when looking at Polygon’s top dApps by users.

Source: Dune Analytics

Polygon and Uniswap, on the other hand, aren’t all roses and chocolate. There is work to be done on a personal level. Since August 2021, the number of daily unique users on Uniswap has been rapidly decreasing. In 2022, there was a particularly significant reduction, with only 16 unique users on February 19th. This isn’t exactly a winning strategy.

Uniswap has also lost roughly $485 million since the beginning of February. This was reportedly so serious that even Uniswap whales chose to remain on the sidelines. Furthermore, the network’s growth slowed to a 17-month low.

Polygon’s MATIC was trading at $1.53 at the time of publication. This came after a 2.55 percent drop in the previous 24 hours and a 10.81 percent drop in the previous seven days.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…