Are you concerned about government overreach in the crypto space? Senator Ted Budd has introduced the ‘Keep Your Coins Act’ to champion your right to self-custody your digital assets. Let’s dive into what this bill means for you and the future of cryptocurrency in the United States.

What is the ‘Keep Your Coins Act’ All About?

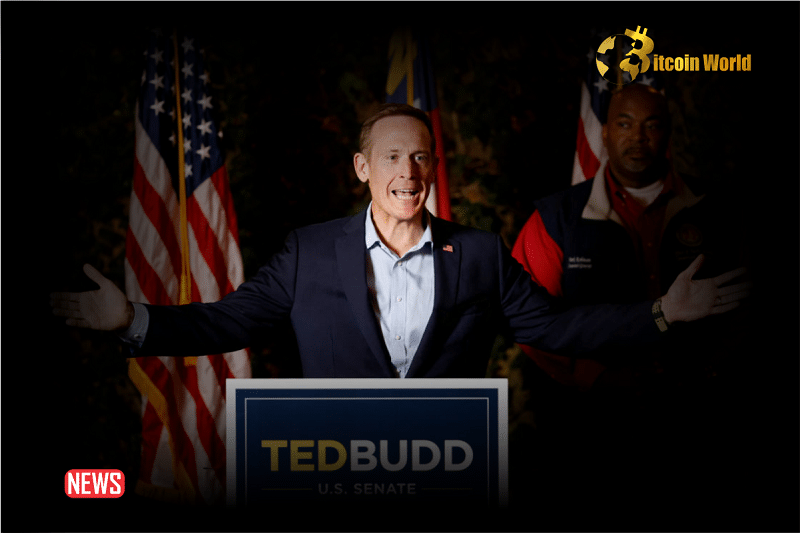

The ‘Keep Your Coins Act’ is a proposed bill designed to safeguard the rights of individuals to maintain control over their cryptocurrencies. Sponsored by U.S. Senator Ted Budd, this act aims to prevent federal agencies from restricting how you use your crypto for everyday purchases and transactions.

- Protection of Self-Custody: Ensures individuals can manage their own crypto wallets without undue interference.

- Freedom to Transact: Prevents federal agencies from limiting the use of crypto for buying goods and services.

- Disregards Crypto Origin: The bill focuses on the usage of crypto, irrespective of how it was obtained.

Key Provisions of the Bill

The ‘Keep Your Coins Act’ is structured to provide robust protection for crypto users. Here are some of its key provisions:

- Restricting Federal Agencies: The bill explicitly prohibits federal agencies from banning or limiting an individual’s ability to use virtual currency for personal transactions.

- Non-Custodial Wallets: It protects the use of non-custodial or self-hosted wallets, ensuring users retain independent management over their cryptocurrency.

- Broad Application: The act covers a wide range of transactions, including the acquisition of both real and virtual goods and services.

Why is This Bill Important?

In an era where digital assets are becoming increasingly integrated into our daily lives, the ‘Keep Your Coins Act’ addresses critical concerns about financial freedom and privacy. Here’s why it matters:

- Protects Individual Liberty: By ensuring users can control their crypto, the bill supports the fundamental right to manage one’s own assets.

- Encourages Innovation: A regulatory environment that respects self-custody can foster greater innovation and adoption of cryptocurrency.

- Prevents Overreach: It acts as a check against potential government overreach, ensuring that federal agencies do not stifle the growth and utility of digital currencies.

The Broader Context: Senator Budd’s Crypto Advocacy

Senator Ted Budd has been a vocal advocate for responsible crypto regulation. The ‘Keep Your Coins Act’ is not his first foray into this arena. In April 2023, he introduced the Financial Technology Protection Act, aimed at combating illicit finance and boosting anti-money laundering measures.

Historical Parallels: Congressman Davidson’s Bill

Notably, Congressman Warren Davidson introduced a similar bill in February 2022, also named the ‘Keep Your Coins Act.’ This earlier effort sought to protect Americans’ privacy rights when dealing with crypto assets, highlighting a consistent concern among lawmakers regarding crypto regulation.

What are the Potential Challenges?

While the ‘Keep Your Coins Act’ aims to protect crypto users, it may face several challenges:

- Regulatory Scrutiny: The bill may encounter resistance from regulators concerned about illicit activities and consumer protection.

- Industry Acceptance: Some industry players may prefer clearer regulatory frameworks to promote wider adoption and legitimacy.

- Enforcement Issues: Ensuring compliance with the act across various federal agencies could pose enforcement challenges.

Conclusion: A Step Towards Crypto Freedom

The ‘Keep Your Coins Act’ represents a significant step towards securing individual rights in the digital age. By protecting self-custody and promoting the freedom to transact, this bill could pave the way for a more innovative and inclusive crypto ecosystem. Keep an eye on its progress and consider engaging with your representatives to support policies that champion your digital freedom.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.