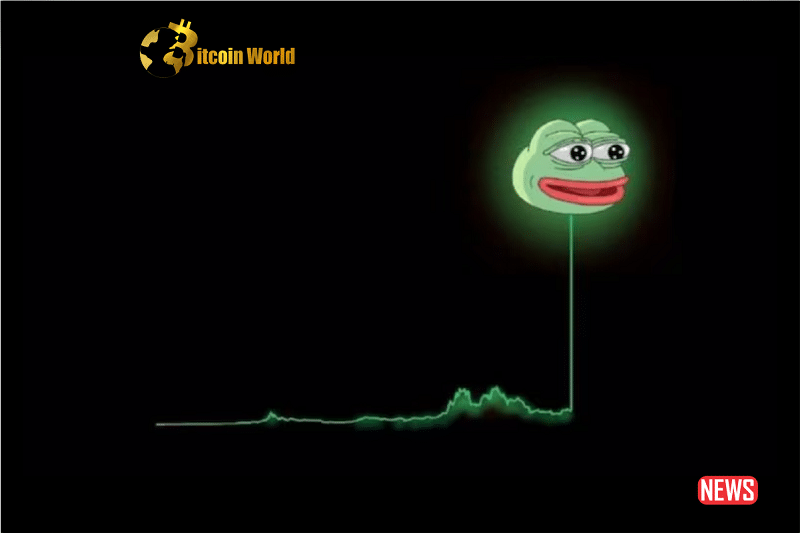

Is PEPE Poised for a Surge?

Memecoin enthusiasts, listen up! With the market’s recent failed bullish attempt, all eyes should now be on PEPE. Why? Significantly, every time market volatility takes a break, PEPE consistently ranks as the memecoin with the highest social volume. At press time, Bitcoin and altcoins were in the bottom range, and interest in memecoins like PEPE was soaring. Additionally, Kucoin announced that PEPE topped the list of most searched coins for the week.

Key Metrics and Indicators: What They Tell Us

Consequently, analysts and traders started digging. What’s fueling PEPE’s social volume? Interestingly, top addresses holding PEPE have been accumulating since mid-August. Furthermore, its weighted sentiment hit rock bottom on August 25 but made an impressive recovery by August 30.

However, despite these promising metrics, PEPE recently plunged to a four-month low. This bearish performance means the coin is oversold. Hence, this could be the opportune moment for PEPE bulls to seize control, especially considering it’s the most searched coin.

To Rally or Not To Rally?

So, does this mean PEPE is set for a rally? Well, not so fast. While accumulation by top addresses is a positive sign for PEPE bulls, it doesn’t guarantee a rally. Moreover, memecoins like PEPE often ride on speculative interest rather than practical use cases, a trait they share with others like Shiba Inu and Dogecoin.

Whales Still Control the Game

The coming days and weeks are crucial for PEPE. The coin is still heavily centralized, with over 96% of its circulating supply in the hands of whales. These big players have the power to drastically impact PEPE’s price action, for better or worse.

Besides, prevailing demand has yet to support a positive pivot for PEPE. However, given its current oversold status and high social volume, PEPE stands a chance at attracting new bullish volumes. Whether it can pull significant demand from the retail segment remains to be seen.

In summary, while PEPE shows some bullish signs amid low market volatility, it also carries its fair share of risks. Either way, it’s a memecoin to keep a close eye on as the market unfolds.