One significant on-chain indication, according to a well-known cryptocurrency specialist, indicates that Bitcoin is approaching a cyclical bottom (BTC).

In a recent video update, crypto analyst Benjamin Cowen informs his 774,000 YouTube subscribers that the profit and loss indicator for Bitcoin, the leading cryptocurrency asset by market cap, is flashing signs of a historical bottom.

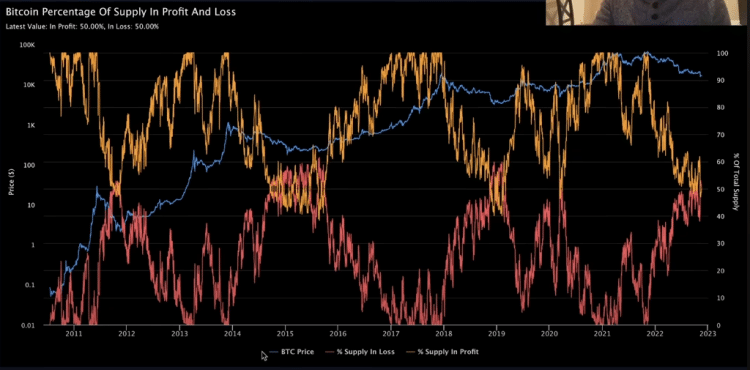

The on-chain indicator displays the fraction of BTC coins that are profitable or losing money for their owners.

Cowen claims,

“One of my favorite on-chain indicators is the Bitcoin percentage of supply in profit and loss. The reason I like this one is because of how cyclical it looks – the ebb and flow of this indicator…

What you’ll notice is that there is a clear ebb and flow to the bear markets and the bull markets…

What you may notice is that they tend to cross at a certain point throughout the bear market, and in fact, in every bear single market, the Bitcoin [percentage of] supply in profit and loss, they cross. Here in 2011, and in 2014, 2015, and in 2018 and 2019, and they’re starting crossing here again in late 2022.”

The 30-day moving average of Bitcoin’s supply as measured by profit and loss, according to Cowen, reveals a historical pattern that frequently heralds a price bottom.

“If you apply the [30-day] moving average to [the Bitcoin percentage of supply in profit and loss]… what you’ll notice is that historically, they have always crossed before the bottom was in.”

At the time of writing, the price of one bitcoin is $16,114, a decrease of more than 3.50% over the previous day.