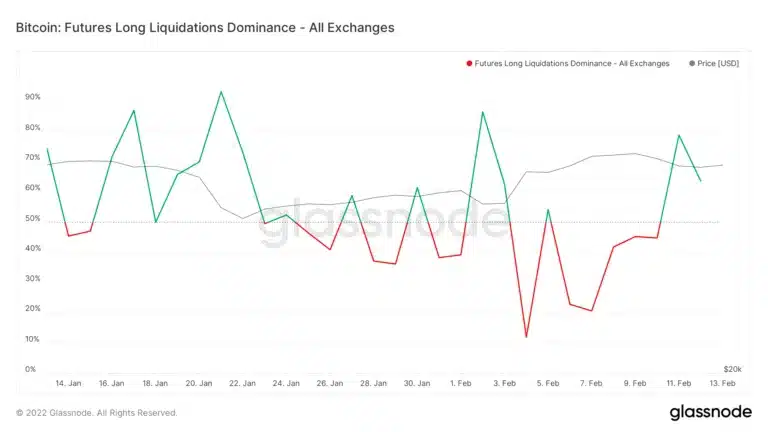

When traders take a position in the futures market and the price swings against them for more than a specific amount of time, they are liquidated.

The percentage of liquidations that are on the “long” side is measured by the futures long liquidations dominance.

Long liquidations accounted for only 11% of all liquidations on February 4th. As a result, 89 percent of all liquidations were on the “short” end of the spectrum. This was most likely due to the price increase from $37,000 to $41,000 one day previously, which caused a short-squeeze. When a large number of traders are caught off guard by a sudden price move, high values in one direction or the other are common.

The long liquidations dominance rate was 61 percent on February 13, a very balanced number.

Source : Glassnode

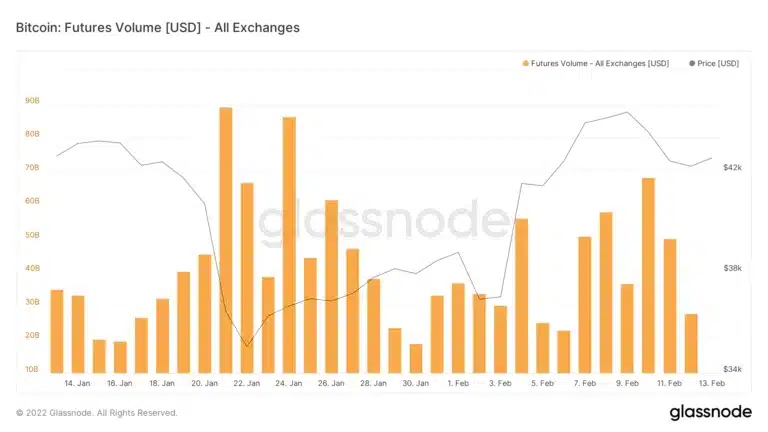

However, futures volume is low in comparison to the previous month. As a result, even if a large number of traders are taken off guard, there is unlikely to be a big price change.

Source : Glassnode

The put/call ratio, which is comparable to the short/long ratio, provides a similar outlook. However, it is focused on the options market rather than the futures market.

The current put/call ratio is 0.77. This means that instead of betting against the market, options traders want to bet for it.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…