BTC Analysis

Weekly ->> Daily –>> 4H

Weekly

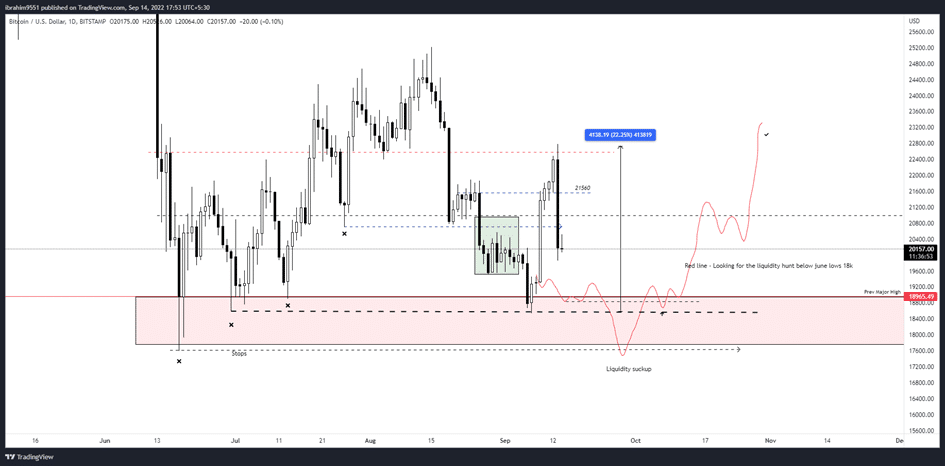

- Recap from the previous week’s thought High time frame price action is been in a bearish trend, Since June drop price ranging between 18k – 24k from the past 2 months.

BTC Daily

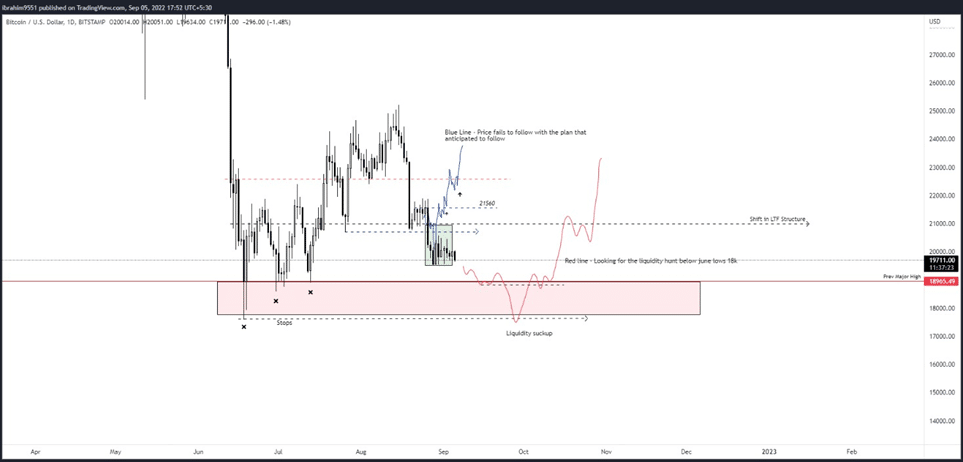

Past week Anticipation !!

- Compared to the previous week’s analysis, the price was then at 19k, we anticipated the price to keep holding at 19k, manipulate toward Red Box (ie 18k), respond to demand and give back a reaction toward the upside direction.

Chart 1 (Previous week )

How did the price change from the past week in the Daily chart?

- As anticipated, price action followed, but instead of taking to 18k lows, the price reverted by retesting the Red Box ( 4H Demand ) at around 18.5k and tapped 22800 which lead to a gain of 22% from the lows.

Chart 2 ( Current week)

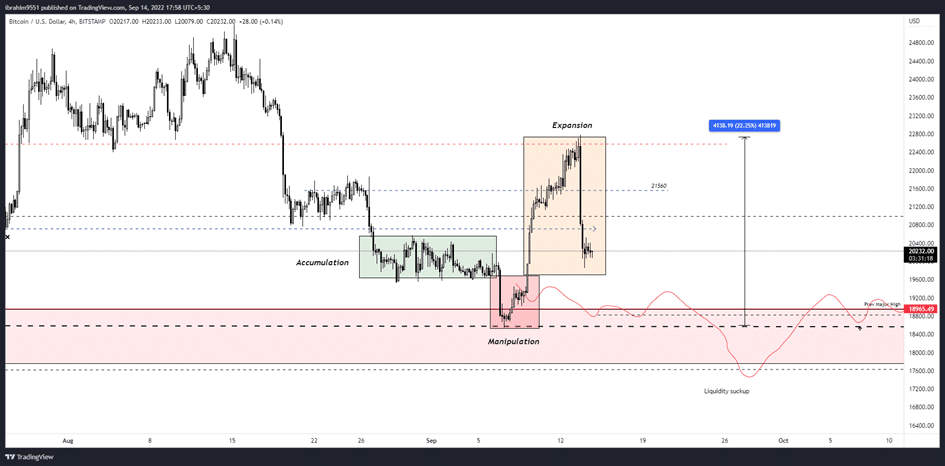

BTC 4H

- Diving deep into the Lower time frame, Price action followed the key 3-phase setup (Accumulation -> Manipulation -> Expansion)

- Accumulated within the range of 19600 – 20400 -> Manipulated to the lows in the demand zone at 18600 -> Expanded from 18600 – 22700

Now

- As the current phase of the crypto market is been driven by the administration and warm regulation, Most of the price action will now depend on the traditional news and FED decision on Interest rates and all the monetary stuffs.

- As of yesterday, CPI reports lead to a plunging in the prices by 10%, Fearing the probability of recursively increasing the Interest Rates to 100bps.

- This fear-driven news will control the market movement, Next week is FOMC, so have to wait to see how the FOMC decision will decide the market movement.

From Technical Perspective

- Price needs to hold 18k-19k

- Nothing bigger is expected in the near time, just ranging and how key levels respond.

ETH Analysis

Daily ->> 4H

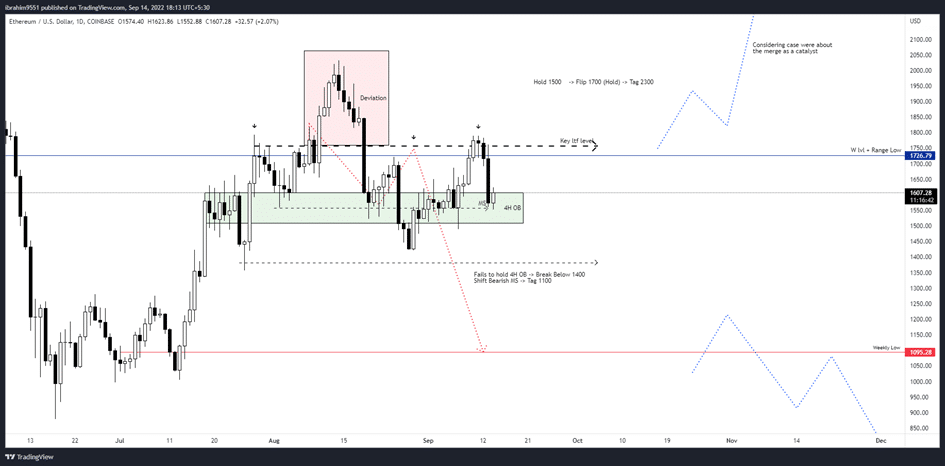

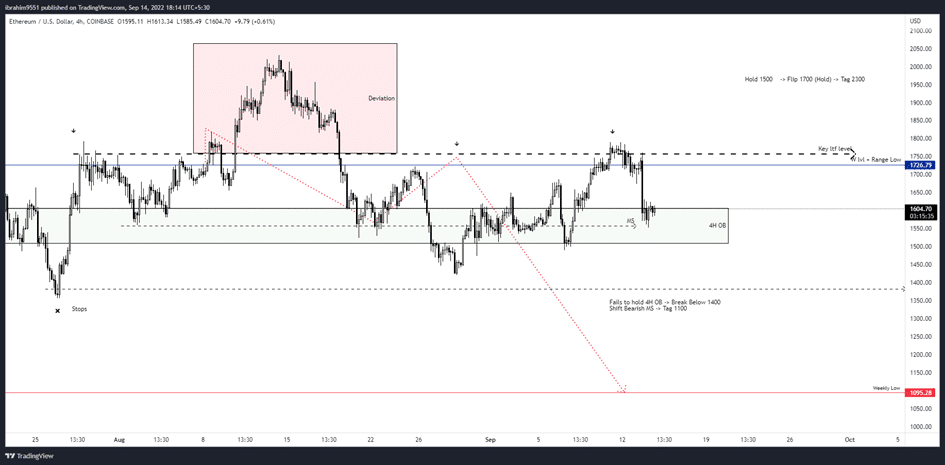

Daily

- Even with the powerful key event hype (THE MERGE ), ETH price action is not able to show any dominant price movement.

- Price still playing within the range 1450 – 1750 with the deviation above toward 2000

- Yesterday, CPI news acted as a bearish confluence at 1726 (weekly key level ) leading to a dumping of the price.

- Still, the RED path following the price will have to keep eye on the development in the price.

ETH 4H

- Nothing much to go into detail in the Lower time frame also, Just to recap that 4H Orderblock still dominantly holding the price

- Loosing 1400 will probably lead the price down to 1000 area.

On-chain Analysis

On-chain metrics turn blockchain-based transaction data into actionable crypto market insights.

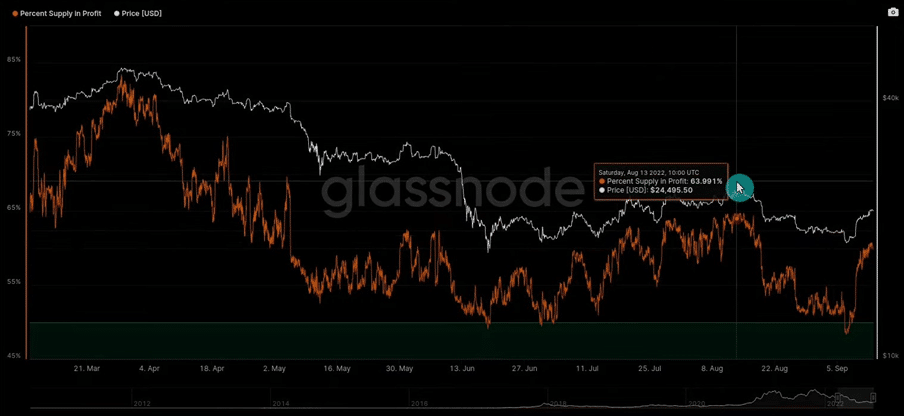

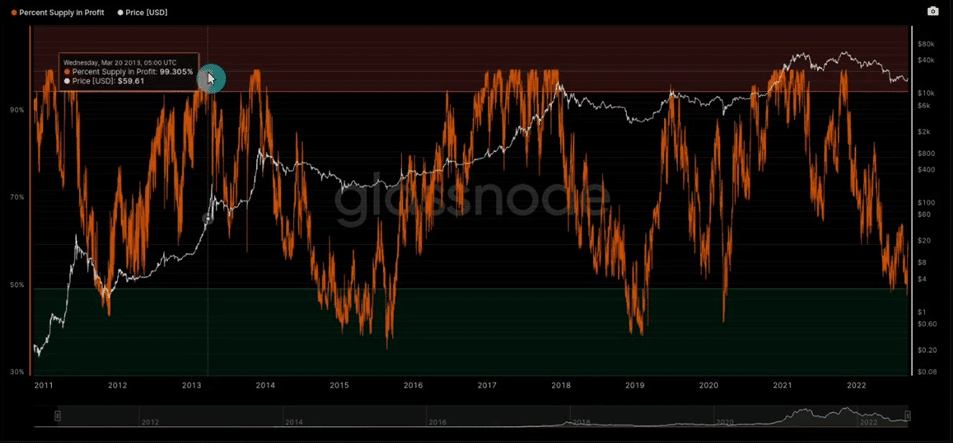

Percent Supply in Profit Deep Dive

- Using the Percent Supply in Profit metric, 2 key market assumptions can be gauged

- Gauging the Major macro shift between profit & loss of total BTC supply.

- Gauging the sentiment of the consolidation, either its accumulation or absorption.

Chart1

- Reading through it, the White line gives the BTC price while the Orange line provides the data with the percentage of BTC total supply in Profit/loss.

- Last Quarter of 2013, 99% of participants holding BTC total supply were in profit.

Chart 2

- Last quarter of 2015, Only 42% of participants holding BTC total supply were in profit.

- Past 2-year price changes gave the assumption of active supply that has been driven by the BTC prices.

With the chart overview, jumping into current market data

Chart 3

- Viewing in the range between Mid June – the current date.

- 49.7% of participants holding BTC total supply were in profits.

Chart 4

- While, at the top of the current range, the profitability increased to 63%, that’s an increase of 13%.

- Given the assumption that 13% of BTC’s total supply is currently actively traded as demand & hovering between unrealised profit & loss.

- Giving a gausing data, that a big set of junk BTC is been actively committed in the deals in the compact range of prices.